Many attendees came looking for the secret sauce to originate loans better, faster and cheaper.

They were looking to gain knowledge to avoid being one of those that will struggle to survive as originations continue to plummet.

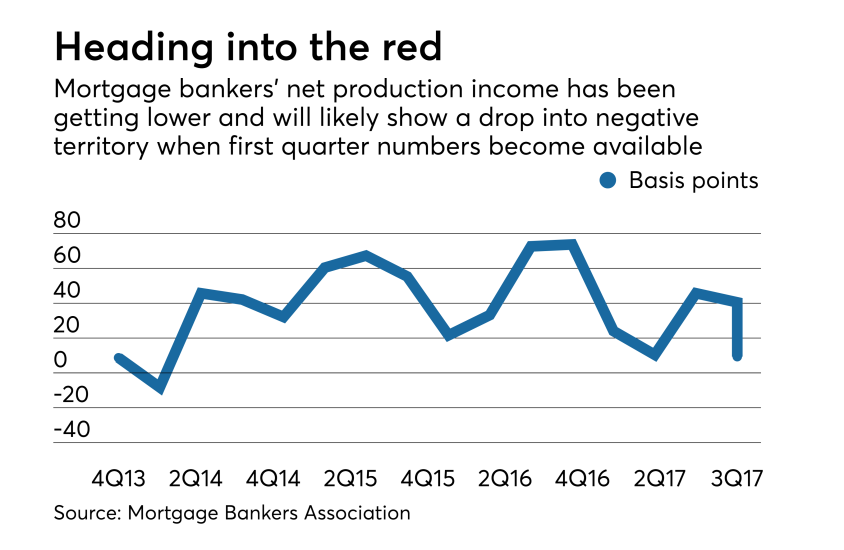

And profitability is now an issue: mortgage bankers lost money in the first quarter for the first time since the first quarter of 2014 due to overcapacity and high expenses, said Mike Fratantoni, the MBA's chief economist.

A tool for survival is the adoption of digital mortgage processes. Ginnie Mae said it will come out with a plan in June that will look at a path for digital mortgages at the agency.

The three agencies whose production Ginnie Mae securitizes — the Federal Housing Administration, Veterans Affairs and the U.S. Department of Agriculture Rural Housing Service — all discussed planned technology upgrades looking to help lenders reduce costs.

And the final general session at the meeting was titled "Securitizing the Digital Mortgage."

Another way to boost origination activity is to work with underserved markets, with speakers at the conference declaring the credit box can be safely expanded using alternative criteria such as rental payments during underwriting.

While the industry did get some good news with the

Here's a look at the top trends from the conference, along with links to NMN's full coverage of the event.

FHA redux

Regulatory shift

Lender consolidation

The digital road

Too little risk