Author:

2025: The Inflection Point for Mortgage Lenders—Seize Refi 'Boomlets' and Home Equity Growth or Risk Falling Behind

With $315,000 in untapped home equity per U.S. homeowner and over 7.3 million borrowers holding rates above 6%, 2025 is pivotal for lenders. But the traditional mortgage playbook is dead—market cycles move too fast. Success now depends on abandoning outdated strategies and embracing digital solutions that scale with the market in real time.

For years, lenders have relied on a predictable cycle: scaling up when refinance and home equity demand surged, scaling back when rates rose. But that playbook no longer works.

Today's market moves too fast, too unpredictably, for lenders to rely on the "hire, hire, hire" and "fire, fire, fire" approach. Refinance demand won't come in one massive wave—it will arrive in short, rapid bursts as different borrower cohorts hit eligibility thresholds. Meanwhile, home equity demand is rising steadily, fueled by record levels of untapped homeowner wealth.

Lenders who wait for the next big cycle will be left behind. Success now depends on extreme agility—the ability to instantly engage borrowers, seamlessly automate processes, and scale up or down in real time. The future of lending isn't about reacting to the market—it's about staying ahead of it.

Mini Refi 'Boomlets' of the Future Will Demand Speed and Agility from Lenders

In the fall of 2024, we saw the mortgage market rally as inflation cooled and optimism around rate cuts grew. This shift led to a surge in refinancing activity, with more than 300,000 mortgage holders refinancing between September and October, according to the

Even with 30-year fixed rates remaining above 6%, this brief spike revealed a critical insight: demand hasn't disappeared, it's just pent-up and growing, with millions of borrowers waiting for the right moment to refinance.

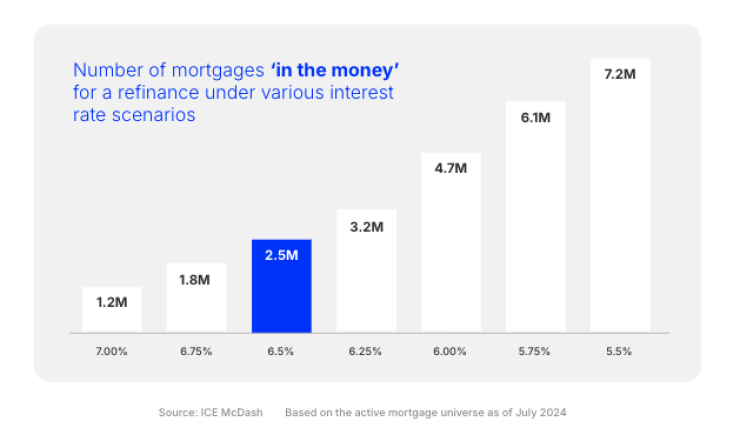

If we look more closely at the number of mortgages spread across various rates, we see that there are––and will continue to be––cohorts of mortgages that are eligible for rate/term refinance as various rate scenarios play out.

According to the

These numbers don't even account for the millions of new mortgages expected in 2025—many of which will be taken out at today's higher rates. As interest rates come down and borrowers meet seasoning requirements, more homeowners will have the opportunity to refinance and lower their monthly payments.

However, this doesn't mean lenders should expect a sudden tidal wave of refinancing in the next several years. The Federal Reserve has signaled a

While rates are expected to remain high for a bit longer, lenders don't have to wait for a drop—there's a significant opportunity to take action now, even in this elevated rate environment.

An Unprecedented And Growing Demand For Home Equity Solutions

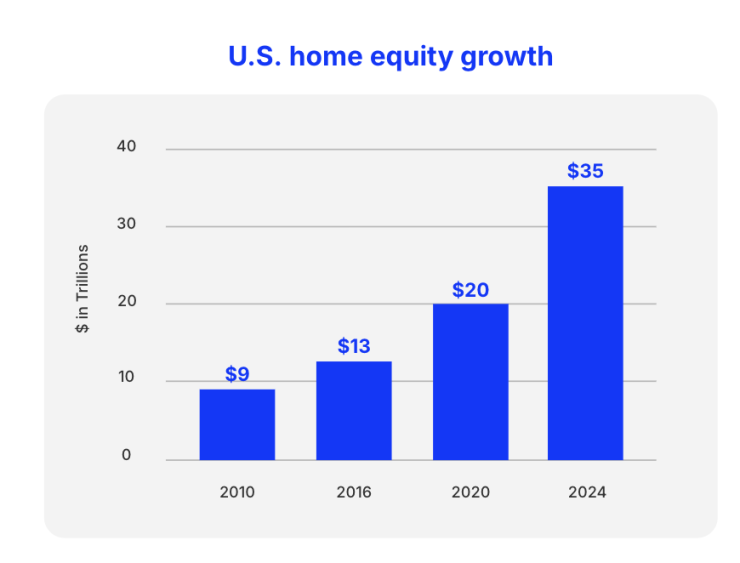

According to the Unison 2024 Annual Home Equity Report, U.S. home equity has surged to $35 trillion over the past 15 years—a staggering 400% increase—driven by rising home values and historically low mortgage rates. Today, the average homeowner holds approximately $315,000 in untapped mortgage equity, creating a significant opportunity for home equity lenders as more borrowers look to finance home improvements, consolidate debt, or cover major expenses.

Similar to refinancing opportunities, waiting too long means missing the window entirely. If underwriting and approval take weeks instead of days, borrowers may get impatient, explore other options, or hold out for a better rate.

However,many lenders still don't have the right technology to deliver near-instant upfront offers at scale, leaving them at a disadvantage when every moment counts.

Why the Mortgage Industry Remains Behind

While other industries have embraced seamless, automated digital experiences, mortgage lending remains burdened by cumbersome systems that largely treat every borrower as if it's their first interaction.

And the numbers prove it: Only 28% of borrowers refinance with their original lender, a stark contrast to the 75–80% retention rates seen in other industries.

According to the most recent

Even if lenders are proactive in their outreach, if borrowers still have to endure lengthy forms and slow approvals,conversion rates suffer. Every point of friction drives borrowers away. And with online rate comparisons just a click away, they have no reason to wait for a lender that makes the process difficult.

To truly capitalize on demand, lenders must go beyond just making applications faster—they must rethink the process entirely.

The Application Is Dead. It's Time to Flip the Traditional Loan Origination Process on Its Head

Imagine a world where borrowers are proactively presented with tailored financial solutions—refinance options, home equity loans, or debt consolidation offers—delivered upfront, based on their individual profile, without the need for cumbersome application flows. This isn't some distant vision. It's happening now.

Lending isn't just about speeding up applications anymore—it's about eliminating them altogether. By leveraging the data they already have, lenders can create smarter, more automated, and personalized journeys that truly make the borrower experience as close to frictionless as possible.

So—how can lenders unlock this application-less experience?

- Leverage extensive data connectivity and automation. Instead of requiring borrowers to manually enter information, lenders can seamlessly verify and pre-fill data in the background, transforming what was once a tedious application into a frictionless borrowing experience. Automation doesn't just eliminate unnecessary steps—it allows lenders to scale efficiently, reduce operational costs, and improve the borrower experience in ways that build long-term trust and loyalty.

- Deliver hyper-personalized product recommendations. Expanded data use and deeper insight into a borrower's financial background allow lenders to move beyond generic, one-size-fits-all offers and instead present tailored, pre-qualified solutions upfront. Whether it's refinancing, home equity, or debt consolidation, proactive, data-driven engagement ensures that borrowers are shown the right product at the right time.

- Anchor customers on a product result upfront rather than waiting for days of manual review. Putting all of this together in one integrated platform will enable lenders to deliver these personalized and proactive application journeys that include instant decisions upfront across multiple different products. And importantly, enable a new level of relationship building by seamlessly connecting all products in their portfolio to help deliver the best financial outcomes for their customers.

The Impact: Frictionless Borrower Experiences That Drive Loyalty And Long-Term Growth

When lenders move to an application-less model, the results are transformational. Borrowers experience a faster, frictionless journey—one that eliminates frustration and unnecessary steps, making access to financial products as seamless as the rest of their digital lives. With a streamlined process, engagement and loyalty increase, as borrowers are more likely to stay with lenders who offer a personalized, intuitive, and hassle-free experience.

At the same time, lenders benefit from significantly lower costs to originate, as automation reduces manual touchpoints and operational inefficiencies. This approach doesn't just improve conversion rates—it also drives higher product utilization and revenue growth, as borrowers are matched with the right financial solutions at the right time.

Lenders who embrace this shift will not only redefine how financial products are delivered but also help build a better, more inclusive financial future—one where access to homeownership and financial opportunity is faster, simpler, and more accessible for millions.

The next market shift is coming—be ready. Visit