Last month U.S.

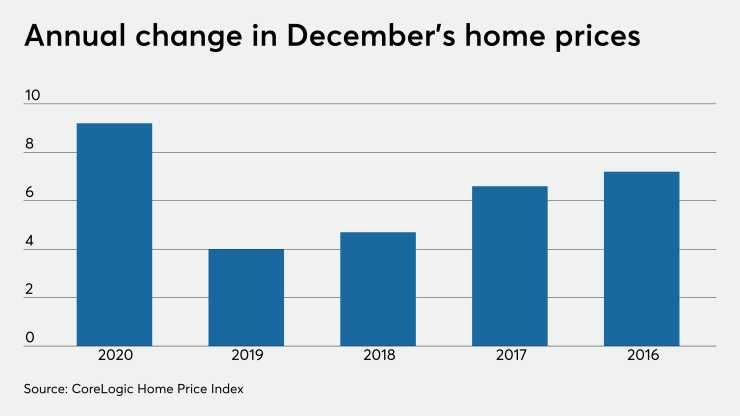

And as home prices rise at the highest rate in 20 years, it has become ever more apparent that the

“These flatlining forbearance rates have generated

They continue: “But this widespread forbearance won’t necessarily happen, even among government loan borrowers who have a higher risk of default due to higher-initial-loan to value ratios, higher debt-to-income ratios, lower credit scores and lower incomes than borrowers using conventional loans.”

Goodman and Neal cite improved loss mitigation policies at mortgage servicers and, as we noted last December (“

From a public policy perspective, the fact that many of the FHA and VA loans currently in forbearance are likely to cure and re-emerge from delinquency suggests that the positive impact of low interest rates on housing prices and housing credit is considerable. But from an industry perspective, the positive outcomes for consumers do not change the fiasco created by Congress via the CARES Act.

Every IMB’s ability to access ample liquidity to withstand contractually obligated servicer advance requirements, margin calls (that occur from hedging various assets including the loan pipeline), and unforeseen market dynamics is different. As we have noted in this column, the industry is currently

When Congress legislated the latest consumer mandate to not pay the cost of a home mortgage or an auto loan, none of the bright lights on either side of the aisle on Capitol Hill considered the cost. You see, mortgage servicers are contractually bound to advance principal and interest due on a mortgage when the consumer does not pay. These payments are made to the institutional investors who own Fannie Mae, Freddie Mac or Ginnie Mae mortgage-backed securities (MBS). These agency and government MBS, in turn, are guaranteed by the U.S. government.

In their haste to legislate this latest consumer mandate last year, neither party in Congress asked what happens to the government-guaranteed MBS when the consumer fails to pay their monthly installment.

“The CARES bill requires servicers to advance up to a year of borrower payments on government-guaranteed/insured and conforming mortgages to every borrower that requests forbearance and attests to financial hardship caused by coronavirus,"

As new loan backlogs start to shrink, however, and refinance volumes inevitably slow, the cash flow shortage caused by the CARES Act will begin to get super critical, particularly in the government loan market served by Ginnie Mae. Smaller servicers of Ginnie Mae MBS will need liquidity support from the Federal Reserve or we could face the prospect of a default caused by the negligence of members of Congress!

The liquidity burden in the government market falls squarely on the private issuers of Ginnie Mae securities. In the conventional market, on the other hand, the GSEs own the loans and the servicing, thus they are ultimately responsible for making the payment to investors on conventional MBS. For this reason, Fannie Mae and Freddie Mac face the same cash shortfall as the private issuers of Ginnie Mae MBS.

In an effort to protect the GSEs from the mounting cash shortfall in the conventional loan market, the Federal Housing Finance Agency took steps to limit loan purchases and other activities, but this just pushes the liquidity problem created by Congress onto smaller issuers.

In June 2020, the

But since June, even as many consumer mortgages have cured, the tab for financing and administering the CARES Act has grown. Both in terms of interest expense and the sheer cost of dealing with consumers, the industry is out hundreds of millions of dollars in terms of expenses incurred for this unfunded mandate from Congress.

The clock is ticking with respect to the unfunded mandates in the CARES Act. A cynic would say that FHFA Director Mark Calabria would like to see mortgage banks fail to endorse his iconoclastic assessment of the risk posed by nonbank mortgage servicers. But in this case, even with the challenges of COVID, the nonbanks would be just fine were it not for the failure by Congress to fully understand and appropriate moneys to cover the cost of the CARES Act.