The

And while

Eroding equity means many distressed homeowners have less chance of avoiding foreclosure the longer forbearance programs and foreclosure moratoria are extended.

Diminishing Delinquency Decline

First, a look at the diminishing returns from forbearance.

The number of active mortgages in forbearance and the number of delinquent mortgages both peaked in May 2020, with the country in the throes of the pandemic-induced economic shock, according to data from Black Knight’s

Given some time to get back on their feet, millions of distressed homeowners were catching up on payments and exiting forbearance while curing or avoiding delinquency.

But the decreases began to deviate in September, at the end of the first six-month forbearance period stipulated by the CARES Act.

Since September, the spread between decreases in forbearance and decreases in delinquency has continued to widen. As of February 2021, forbearance numbers were down 43 percent from the May peak while delinquency numbers were down only 22 percent over the same period. This translates into a decrease of 2 million homeowners in forbearance compared to a decrease of less than 1 million (969,614) in delinquency. Seriously delinquent mortgages decreased by only 310,378 — or 12 percent — over that same time period.

Eroding home equity

Time alone will not be able to heal many of those stubbornly remaining seriously delinquent loans. That’s because more time means more missed mortgage payments, and that translates into eroding home equity — the last remaining foreclosure prevention lifeline available to many distressed homeowners.

A Black Knight

Mortgages balances inflated by forborne interest, taxes and insurance would result in a higher share with less than 10 percent equity — important because that’s the minimum amount of equity typically needed to sell a home on the traditional real estate market and thereby avoid foreclosure.

Black Knight estimates that 22 percent of all mortgages in forbearance would have less than 10 percent equity after 18 months of forbearance — more than double the 10 percent at the beginning of forbearance. That low equity percentage balloons to 36 percent for FHA mortgages after 18 months of forbearance.

Lower equity equals higher foreclosure risk

Not surprisingly, most properties that end up foreclosed have less than 10 percent equity. Over the last eight years, 84 percent of foreclosure sales on the Auction.com platform had less than 10 percent equity. The equity for these foreclosure sales was calculated by comparing the total debt owed on the mortgage in foreclosure to the final sale price at the foreclosure auction.

Leading up to the pandemic, the share of low-equity foreclosures was on the decline, hitting an all-time low of 73 percent in Q1 2020. But even with

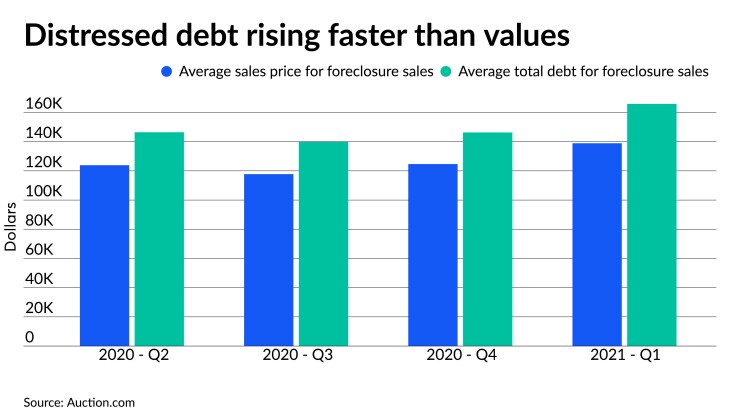

The increasing amount of negative equity at foreclosure sale is not because distressed property prices are declining. The average price for a foreclosure sale in Q1 2021 was $138,904, up an impressive 11 percent from the previous quarter. But the total debt owed on properties being foreclosed has been rising even faster than sales prices, up 13 percent in Q1 2021 compared to the previous quarter. That marked the biggest quarterly rise in average total debt in more than eight years.

The first quarter spike in average total debt on

On the other hand, the sooner those delinquent loans can be put on a more proactive servicing path, the more likely the distressed homeowners will be able to avoid foreclosure — either through loss mitigation that returns the loan to performing status, or through a pre-foreclosure sale that leverages any home equity to allow for a graceful exit from the property.