The volatility that has roiled the short-term money markets since December has raised questions as to whether the Federal Open Market Committee should continue to target federal funds as a policy tool. For mortgage lenders, owners of servicing and bond investors, the question of whether the FOMC can control its target range for federal funds is crucially important.

Everything from the huge to-be-announced market, which are forward-settling mortgage-backed securities trades, to bank warehouse lines, to MBS and whole loan repo trades, price against short-term interest rates. When the Fed is unable to manage both the floor and the ceiling of its fed funds rate target, and allows rates to swing wildly from day-to-day, this volatility spreads to the entire house finance complex.

For those working in housing finance and specifically in the secondary market for residential mortgage loans and MBS, it is apparent that the swings in short-term interest rates going back to last December were caused by a number of factors. First, the FOMC was

The level of reserves was allowed to fall too fast and too far, resulting in widespread problems across the money markets. To use a fishing metaphor, we could see the rocks in the water. The FOMC

But more than the relatively scarcity of reserves, the tightness seen in the money markets is also a function of bank regulatory policies that discourage lending.

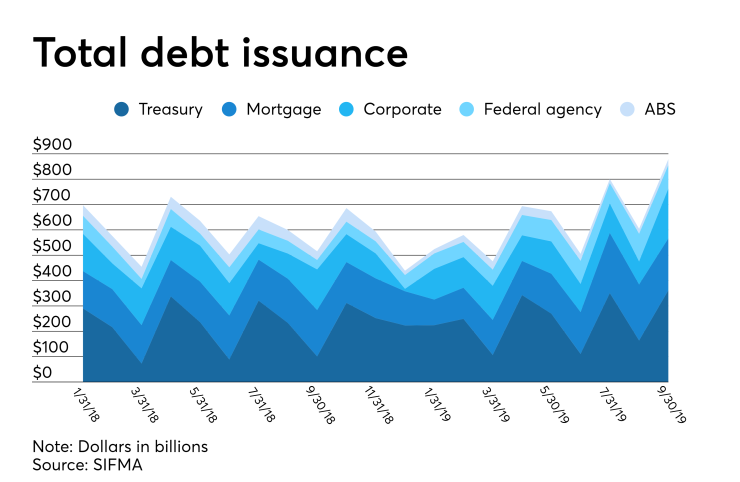

Basel III and related regulations on liquidity essentially discourage the biggest banks from lending, particularly at the end of the quarter or year. Last December, many of the largest money center banks simply turned away from the markets, sending prices for stocks and bonds plunging more than 20%. New issuance of corporate securities as measured by the

The issuance of mortgage-backed securities slid from September 2018 to just $100 billion or half normal issuance levels by January 2019, including both residential and commercial real estate loans. The dramatic decline of interest rates during the first half of 2019 helped mortgage lending and securities issuance rebound to what may now be one of the best years for the industry in half a decade. Needless to say, a lot of mortgage bankers and TBA traders are glad to see the volumes, but we do wish that the FOMC would stop adding excessive volatility to the markets.

While the FOMC has now inundated the markets with liquidity and has started to purchase T-bills in order to further steepen the yield curve, the real question for mortgage bankers is whether the Fed can actually control the short-term money markets effectively. This is especially important because the U.S. is getting ready to

During August and September, the AAA-rated agency collateral from the GSEs and Ginnie Mae traded well above the previous fed funds target set by the FOMC, leading many mortgage bankers to wonder if the Fed understands the cost of volatility in the world of mortgage finance. In a business where a few basis points can make the difference between profit and loss in the secondary loan market, seeing overnight rates for risk-free agency repurchase agreements swing hundreds of basis points in a day is not helpful. Thankfully the FOMC has announced open market operations through the end of the year in order to assure markets that there will be ample liquidity.

There are two big questions for the FOMC that concern all of the participants in the world of nonbank finance, particularly the $2 trillion per year secondary market in residential mortgages and related interest rate products like the TBA market. First, will the primary dealers inside of the major banks provide liquidity to the markets? Or will year-end 2019 be another train wreck when the money markets essentially closed down? Whether the largest banks can or will pass through cash to the broader market is still and open question.

The bigger challenge facing policymakers is whether the FOMC should continue to target the federal funds rate as a policy tool. Many FOMC members are said to support a broader policy to manage the shape of

For many financial professionals working in the mortgage markets, however, the proof of the FOMC's latest policy pronouncements will be seen in the results. The lack of liquidity that caused mortgage lending and financing volumes to fall in 4Q 2018 is threatening the markets again, but this time around at least the FOMC is no longer talking about raising interest rates. Ultimately, whether the FOMC can defend the 1.75%-2% range for fed funds, including the key overnight financing rate for dry mortgage loans and agency securities, will be the metric that mortgage bankers use to determine whether the Fed has solved the liquidity problem.