Despite all the concern about forbearance reporting discrepancies over time, transparency remains an issue.

This is the year that should change.

It's getting a little easier to see forbearances in investor reporting, but not as easy as it should be given all the concern voiced about it by investors, regulators, researchers, reporters and ratings agencies like

"The information has become more expanded and more transparent," according to Natasha Aikins, a director at Fitch Ratings in New York.

But it's still not always clear in reporting whether a loan includes forbearance, and that means all stakeholders have a lot more work to do.

It would be easy if everybody followed the Treasury's reporting

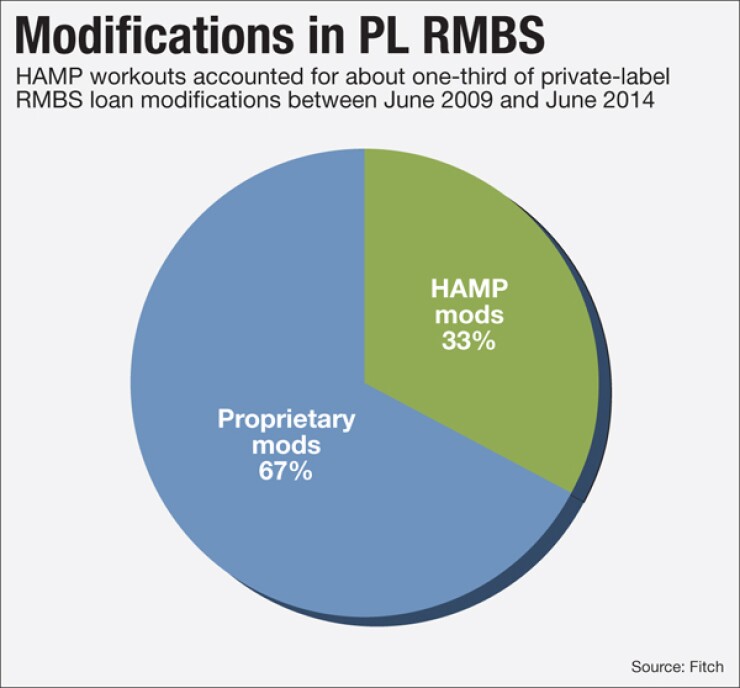

About one-third of the roughly 1.5 million private mods implemented in private securitizations between June 2009 and June of last year were HAMP workouts. But the remaining two-thirds of these mods are proprietary and might not use HAMP reporting, according to Fitch.

Proprietary mod reporting may be governed more by individual deals' pooling and servicing agreements than HAMP guidance. In that case, "We're servicing at the direction of whoever securitized it," said Gordon Albrecht, senior director at special servicer FCI Lender Services Inc.

This direction is defined by securitizers' contracts with investors, he added, and increasingly, investors mindful of growing regulatory oversight want HAMP-approved servicers and HAMP protocols followed whenever possible, even when they are not required, he said.

But some securitization contracts call for delays in forbearance reporting until the loan is liquidated, according to Fitch. In that case, a proprietary principal forbearance that is eventually paid off may never be recognized and is difficult for investors to see.

Investors have a right to know whether there is forbearance and when loss recognition might occur because the timing of losses affects how, when and which particular securities holders receive cash-flows from a deal.

Not only are there discrepancies in how proprietary mods are reported that complicates this, there is a third gray area that investors have had questions about: situations where a proprietary mod with forbearance fails and servicers try a HAMP mod instead.

The industry needs to be particularly clear on how to handle these situations now because they are likely to become more prevalent.

A large number of HAMP and some proprietary mods are entering a period where their rates step-up and put additional strain on borrowers, so servicers might be more frequently moving to a different mod if the first one isn't working anymore.

"Many loan owners would be happy to put the loan into HAMP if a proprietary mod re-defaults and qualifies," said Ed Fay, CEO of Fay Servicing.

So how should servicers handling private deals report forbearance in this instance?

"Any prior forbearance amount may be capitalized to the extent such forbearance is permitted under, and any required disclosures comply with, all applicable laws," according to the Treasury.

Servicers should make sure they have a strong justification for whichever reporting method they use in order to avoid

"It would seem to me that you are better served and you look more transparent if you use the HAMP mod language, which — considering how much regulatory oversight is coming down the servicers' road — is a way to say you have a defendable position," said Vincent Fiorillo, global sales manager at DoubleLine Capital LP, and the president of the Association of Mortgage Investors' board.

"I'm not saying it's the one we like, but it's there," he said.

Where PSAs are vague, servicers deciding whether or not to use HAMP reporting protocols may want to look to what most of their peers are doing to establish a defensible policy in this area, assuming there is a consensus.

Fitch initially suggested in a

But later, the ratings agency later

One past

This shows there is a need to drill down further into servicer practices. Investors and servicers need to know for sure whether there is any market consensus within the proprietary market, and whether it is backed by deal PSAs.

There will hopefully be go-forward standardization of reporting in this area that will improve transparency.

The problem is it's not an immediate priority for newer securitizations, which have been backed by

But clearly, there is investor interest in new deals backed by higher-risk collateral, so it will likely be needed down the road.

In the meantime, it's the legacy securities that still represent the bulk of private securitization market, and these need to be addressed.

Although Fitch analysts said they are seeing some servicers provide more forbearance information to investors in these securities, clearly specific servicers' practices are still not clear enough.

Whatever methods servicers use to track and/or report forbearance, they should be able to clearly explain and disclose which loans have how much of it. If they haven't done this before now, they better be ready to do it this year.