Later this month, the Federal Housing Finance Agency is expected

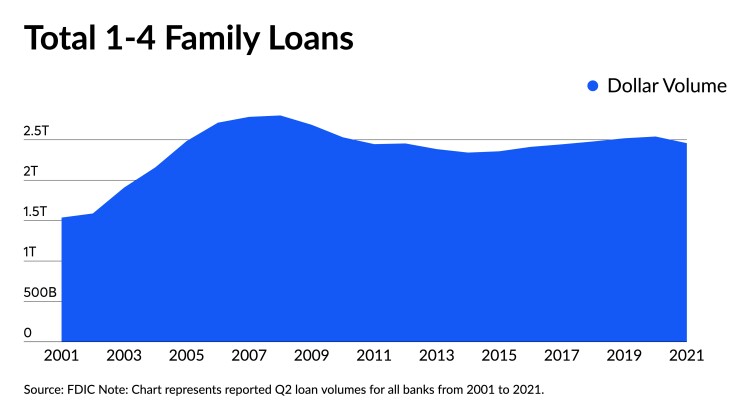

Fannie Mae and Freddie Mac are restricted by law to purchasing single-family mortgages with origination balances below a specific amount, known as the “conforming loan limit.” Loans above this amount are known as jumbo loans, which is primarily a market for large depositories. U.S. banks own $2.4 trillion worth of mostly prime 1-4s held in portfolio, down from $2.8 trillion in 2008.

Almost all residential loans are underwritten and documented to the conventional loan standard regardless of size. But lost in the mix are smaller loans, which tend to be less profitable for lenders and undesirable for investors and servicers. The market for large conventional and jumbo loans needs no help from policymakers, but smaller loans which produce less income do need support.

The impending increase in the size of the loans eligible for purchase by Fannie Mae and Freddie Mac illustrates how the FHFA, which is increasingly focused on broadening access to credit, is instead forced to adjust policy for rising inflation. The Federal Open Market Committee has failed in its mission to ensure price stability in the U.S., leaving the Biden administration as owner of the inflation problem.

Despite the fact of doubt digit home price appreciation, FHFA acting Director Sandra Thompson put affordability at the top of the annual to-do list for the government-sponsored enterprises. In its

Of note, Thompson has also instructed the GSEs to resume risk-sharing transactions, reversing a largely political decision to end the program by former director Mark Calabria.

“Key to the enterprises fulfilling their statutory mandates is their ability to advance sustainable and affordable homeownership and rental housing opportunities, and to improve their capital position by transferring credit risk away from the taxpayer,” Thompson said last week.

The GSEs should work to increase the availability of small-balance mortgages, the scorecard instructed, and make recommendations to facilitate greater affordable housing supply. The FHFA also said the GSEs should finish the validation and approval of credit score models and move to implement those changes.

Talking about affordability is great, but unfortunately the GSEs will spend much of 2022 buying fewer, larger mortgages, at higher cost and that rely upon established credit score models. Even as the FHFA attempts to cajole conventional issuers to focus on smaller, less profitable mortgages, the industry is actually focused in an entirely different direction.

The limits on the GSEs’ purchases of loans for non-owner-occupied homes, for example, are areas where conventional issuers are hoping for change. Some issuers say that allowing the GSEs to again purchase NOO loans would hurt the non-QM market. In the meantime, the private, “non-QM” market for jumbo residential loans and other types of financing for residential properties remains quite strong.

“I think the low interest rate environment and strong production volumes means that non-QM hasn’t been a focus for originators. As rates start to rise and we have excess capacity in the system as the mortgage market shrinks, we expect to see a lot more non-QM activity,” one bank executive tells NMN.

“Given the recent rule change, much of our historical non-QM purchases now fits into our other programs,” notes Chris Abate, CEO of Redwood Trust. “That said, we see the non-QM market as continuing to grow meaningfully.”

“Much of the recent origination in non-QM is in alternative-documentation type loans, portions of which are underwritten based on bank statements or CPA-reviewed P&Ls,” Abate continues. “Securitization execution has been favorable and loan rates have moved in sympathy. Given the types of non-QM currently being produced, we don’t see much linkage to GSE loan limits as the related guidelines have very little overlap.”

One area where FHFA can meaningfully support small balance loans is by easing the restrictions on the GSEs buying and insuring seasoned loans made by community banks and credit unions, two of the chief conduits for making smaller loans to low-income communities.

“We are not reviewing bulk purchase transactions at this time,” says

Under Mark Calabria, the FHFA shut down the “structured desks” of both GSEs, closing an important avenue for small depositories to liquefy their portfolios. These are performing, well-underwritten and seasoned loans of 1-4-family properties held in the retained portfolio of federal insured depositories. Yet for some strange reason, the Biden administration has yet to reverse this unfortunate decision.

Non-banks typically make larger loans and immediately sell them because they lack the capital to accumulate assets and also seek to avoid interest rate risk. Banks and credit unions, however, want to keep loans in portfolio, depending on whether there is demand for new loans that might exceed the bank’s capital and liquidity.

If there is a need for credit, however, small depositories often have few ways to increase lending by selling loans at a reasonable price. Without an alternative source of liquidity provided by the GSEs, smaller banks and credit unions are at the mercy of the largest depositories and nonbank aggregators.

The GSE charter requirements set forth by Congress include providing "liquidity" to the secondary market, but this path is currently blocked. If FHFA truly wants to see more small balance loans made to low-income households, community banks and credit unions are the best conduits. Both in terms of loan originations and managing any credit problems that may occur, Main Street lending is the answer.

Smaller loans that may be a loss-leader for a larger nonbank issuer or money center bank make good economic sense for smaller lenders, who are less yield sensitive, have deposits to fund the asset and find retaining loans and servicing attractive. Also, by facilitating structured transactions for small depositories, the GSEs can provide liquidity to mitigate balance sheet issues facing community banks and credit unions.

For example, if the small bank has lent out most of its allocation for 1-4-family loans, but has demand for new credit in the community, it can sell some assets into a conventional MBS and thereby create capacity. Here we are talking about qualifying and insuring loans for sale to investors in MBS, not for retention in the portfolio of GSEs.

By restoring this important source of liquidity for smaller lenders, the FHFA can make the targets in the new scorecards a reality. FHFA should consider allowing small depositories, those defined by regulators to be below $10 billion in total assets, to again make use of structured transactions for seasoned, performing loans.

It is ironic that one of the last remaining legacies of Director Calabria that remains in place also happens to be the one change available to FHFA that can help to address affordability in the age of inflation. FHFA Director Thompson should use her knowledge of the banking world to make this change a priority before the new year.