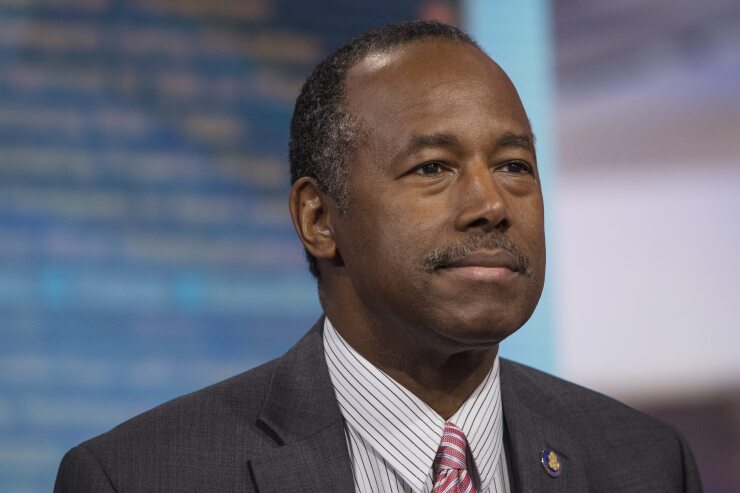

Housing and Urban Development Secretary Ben Carson sent the wrong message to the mortgage industry when he said the use of the False Claims Act to stop fraud by companies engaged in Federal Housing Administration loans is a “problem” that “we’re already addressing.”

Carson made his comments at a

Carson characterized use of the False Claims Act to fight fraud in FHA lending as “ridiculous, quite frankly.”

That statement may delight the mortgage industry but does not bode well for taxpayers or the federal government’s future fraud enforcement efforts. The False Claims Act is the strongest enforcement weapon the government has to fight civil frauds that cause financial harm to U.S. taxpayers. Indeed, removing the False Claims Act from the Department of Justice’s arsenal of tools to combat fraud involving FHA loans is what is ridiculous, quite frankly.

The False Claims Act redresses frauds against federal programs and recovers taxpayer funds lost to fraudulent practices. Both the Department of Justice and private citizen whistleblowers can initiate cases under the FCA. The sanctions are serious, forcing companies to pay three times the amount of damages the government suffered plus penalties for each false claim. The law has been massively effective, returning more than $60 billion to the federal government and states, including related criminal fines.

Carson seems not to understand how important the False Claims Act is to the effort to fight fraud against the government. He apparently has adopted the mortgage industry’s view, which Trott espoused, that FHA lenders have been prosecuted for “immaterial defects” in originating, processing and underwriting FHA loans. That is a false characterization of those cases.

First, for a company to be liable under the False Claims Act, the law says the false claims must be made “knowingly” and must be “material” to the government’s payment. This means a company would not be liable for a clerical error or other inadvertent mistakes. To be “material,” the law says, the violations must be significant enough that they would “influence” the government’s decision to make payments. The Supreme Court provided further clarification about what is considered “material” in a significant decision last year in

Second, the violations at issue in past False Claims Act cases against FHA lenders are egregious — not “immaterial.” For instance:

- JPMorgan Chase admitted in a

settlement agreement with the government that for more than a decade, it approved thousands of FHA loans and hundreds of Department of Veterans Affairs loans that were not eligible for FHA or VA insurance. JPMorgan Chase also said it did not notify the FHA and the VA when its own internal reviews determined that more than 500 defective loans should never have been submitted for FHA and VA insurance. The company paid $614 million in 2014 to the government to settle a “qui tam” whistleblower case that exposed those problems.

- In a separate settlement agreement in 2014,

SunTrust Bank admitted numerous violations, including that it originated and underwrote FHA-insured mortgages between 2006 and 2012 that did not meet FHA requirements and were therefore not eligible for FHA mortgage insurance. Management was notified through audits and other documents that there were significant flaws and inadequacies in SunTrust’s origination, underwriting and quality control processes and that as many as 50% or more of SunTrust’s FHA-insured mortgages did not comply with FHA requirements. SunTrust failed to self-report to HUD even the defective loans it did identify. SunTrust paid $418 million to settle its False Claims Act liability as part of a $968 million settlement with the federal government and 49 states.

Carson, Trott and mortgage industry representatives have said that big banks are leaving the FHA loan business because the government’s use of the False Claims Act makes it too expensive. In reality, the False Claims Act has made fraud less profitable than it used to be — and that is the way it should be.

It is the FHA — not the lender — that is financially responsible if there is a loan default. Lenders’ failures to comply with the program’s rules have caused the FHA to pay hundreds of millions of dollars in ineligible claims. In addition, loan defaults and foreclosures have a devastating effect on homeowners.

Rather than telling lenders that the government will back off using one of its strongest civil enforcement weapons, Carson should be telling them that defrauding the FHA loan program is unacceptable and that those who do so will be held accountable.