There is a body of opinion in Washington that the best way to move on from the conservatorships of Fannie Mae and Freddie Mac is to develop legislation to create a new housing finance system that retains a government backstop.

However, there can realistically be only muted hope that today’s Congress, nine years after the conservatorships started, will agree on a feasible strategy to unwind Fannie and Freddie and replace them with a viable alternative. Washington is too divided; the chances of a bipartisan bill are still in question.

Of course, Congress doesn’t need to act to end the conservatorships. The Housing and Economic Recovery Act of 2008 in fact empowered and delegated the Federal Housing Finance Agency with the legal authority and responsibility to bring Fannie and Freddie out of conservatorship — assuming they can be sufficiently capitalized — and reform their regulation. The law could not be any clearer about the FHFA’s authority to set the housing finance system on a proper footing without direction from Capitol Hill.

Regardless of whether Congress could act, some supporters of proposals to recast or eliminate the two government-sponsored enterprises — and yet retain government support for mortgage assets — don’t seem to fully consider the complexities of transitioning to a future without Fannie and Freddie. Whenever elaborate financial policy reforms are implemented, a variety of economic, political, market and regulatory forces all necessarily intertwine over time to determine whether a policy will be successful, or an unintentional failure. Unfortunately, policymakers have all too often failed to rely on a clear fact-based analysis of the risks and bad incentives they may be cultivating over the longer term. History tells us that it often takes decades before the impact of such a financial stew ferments into intended or unintended consequences.

The savings and loan crisis of the late eighties and early nineties is a perfect example of how good intentions can produce dire unintended financial consequences many years later. Its seeds were sown in the 1960s, when consumer deposit interest rate caps for S&Ls were capped at 5.5% to favor the S&Ls over banks and therefore help spur mortgage lending. But the market did not cooperate — interest rates in the country generally increased to unprecedented levels, hitting double digits by the early 1980s.

Depositors naturally abandoned banks and thrifts in favor of money funds which were paying about 10%. In response to this massive disintermediation, the government eliminated Regulation Q’s interest rate caps in 1982. But S&Ls then had to pay double-digit interest rates to remain liquid, while their assets consisted of 30-year fixed-rate mortgages yielding about 7%. This created negative spreads that burned through their capital. The die was cast at that point through the implementation of half-baked public policies.

So what is an example in some of the current GSE proposals of ideas that may have unintended consequences? Well, the capital base underlying a reformed housing finance system, for one. Large amounts of capital will undoubtedly be needed in a non-conservatorship future. This is particularly true since 100% of the profits that Fannie and Freddie have been earning over the last few years have been “swept” into the U.S. Treasury, and government policy has set Fannie and Freddie on a flight path to reach zero capital by January 1, 2018.

In a

Put another way, if their rights are eviscerated by whatever solution is forged, it will not only produce a volcano of litigation (which has already begun) similar to the “goodwill” cases brought by purchasers of failed S&Ls, it will impact negatively on the market’s willingness to provide the future capital that Fannie and Freddie (or their descendants) will need, as well as the cost of that capital.

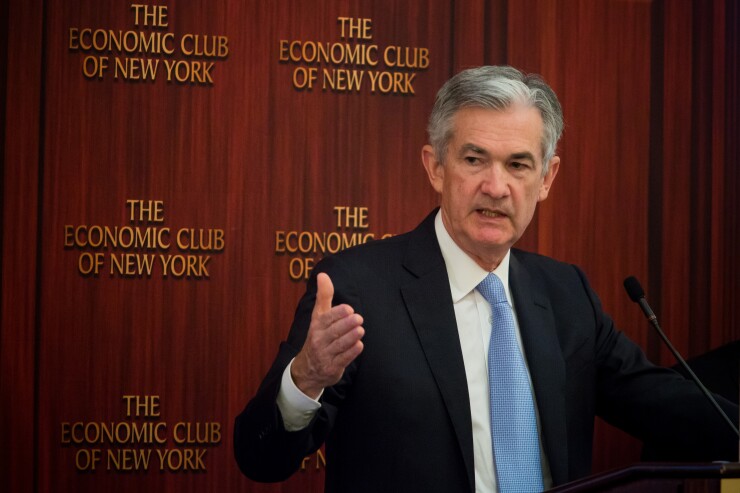

Powell, some lawmakers and other commenters have also called for any future government guarantee to be explicit and transparent — rather than Fannie and Freddie’s implicit guarantee — and apply only to the mortgage securities issued under a new system.

But one byproduct of such an explicit government guarantee of GSE-backed MBS (that is presumably not extended to private-label MBS), which is hardly mentioned, is the likely reduction of risk-weighting of those securities for bank capital purposes — perhaps to zero. This would make them among the most attractive of investments. But like the incentives that were built into the Volcker Rule favoring government securities, such guarantees could have market- and liquidity-related effects that were never analyzed or intended.

Guaranteeing mortgage security instruments could also change the risk profile for taxpayers. As the last crisis proved, relying on deposit insurance in a widespread financial crisis to resolve failing banks can be more costly than guaranteeing the banks (as carried out by the Troubled Asset Relief Program.)

While returning Fannie and Freddie to the ranks of the private sector does require rigorous analysis, it is an admission of defeat to keep them in conservatorship. The FHFA has the full authority to end the conservatorships, and implement positive and attainable reforms. The only missing ingredient now is the will of the government.