Zillow Group is rebranding Mortgage Lenders of America, the call center originator it bought last year to provide property purchasers from its home flipping business with financing.

The mortgage banking business is now called Zillow Home Loans.

"With Zillow Home Loans we are taking an incredible step forward to deliver an integrated payments platform to complete the financing for Zillow Offers that delivers a more seamless, on-demand real estate experience today's consumers expect," Erin Lantz, Zillow Group's vice president and general manager of mortgages, said in a press release. "We continue to offer consumers the power of choice to shop for loans directly through Zillow Home Loans or through our popular mortgage marketplace."

Previously, Lantz

Zillow is the second fintech company to rebrand its mortgage operations this week; SoFi

Because of the lead generation marketplace, Zillow is licensed as a mortgage broker in 40 states and the District of Columbia, although it does not use those to originate any loans. Those licenses are being held separately in the Zillow Group Marketplace subsidiary, a company spokesman said.

Zillow Home Loans will not be a participant in the custom quotes mortgage marketplace. However, even before the acquisition, MLOA was and still is a participant in the Connect marketplace, which does display lender advertisements, but the listings are based on specific answers provided by the consumer depending on their unique situation, the spokesman said. MLOA averaged about 4,000 loans annually the last few years, and consumers in the marketplace requested about 25 million loans in 2018, he added.

Even with the small number of transactions, there have been a number of critics about the deal; the National Association of Federally-Insured Credit Unions used this as the primary example of why fintechs need to be held to

In

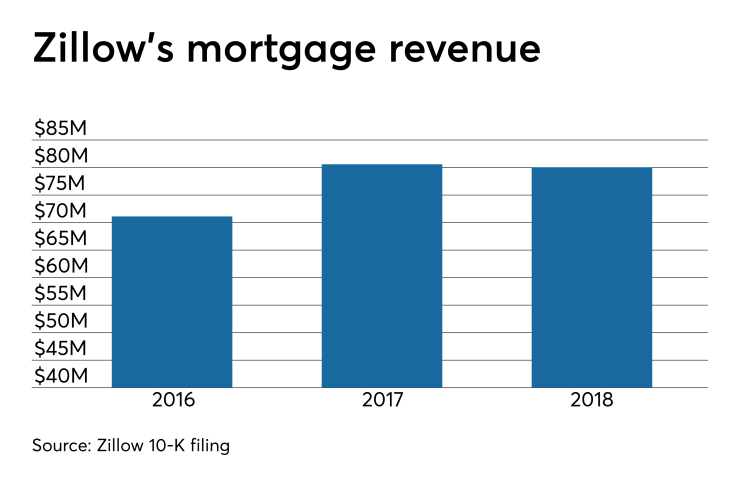

Mortgage was included in the Internet, Media & Technology reporting segment. Going forward, mortgage will be its own segment, and besides the lead generation and origination units, will also include Mortech, which offers a product and pricing engine.