While housing can be the tool to help close the economic gap between Blacks and whites,

A typical Black household has only about 23% of the wealth of a typical white household. This is a larger gap than prior to the Great Recession, when Black households had 34.6% of the wealth of white households.

"The issues caused by

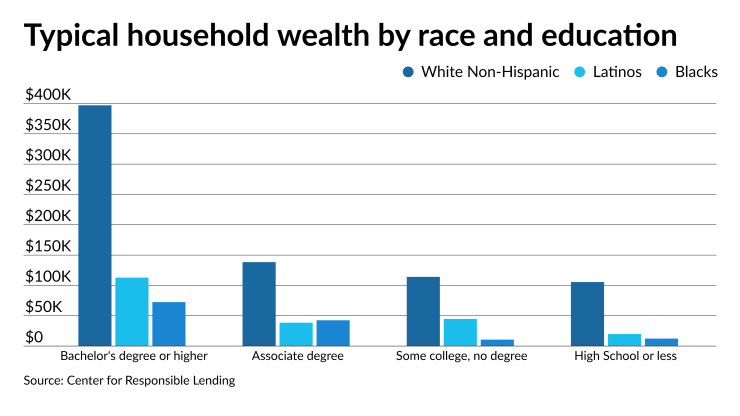

A wealth gap also persists based on education level, a separate report from the Center for Responsible Lending noted. For those who have a bachelor's degree or higher, the typical white household had $397,000 in wealth, while for Latinos it was $112,700 and for Blacks, it was $72,450. For whites with a high school education or less, household wealth was $105,590.

Zillow analyzed home value growth and

But even in the most optimistic scenario, in which Black home values grow 15% faster than the overall market and the homeownership grows at 1.5 percentage points per year, it would take about 45 years from now, until 2066, to achieve housing wealth equality.

Some progress in closing the housing wealth gap, Zillow noted. The

In February, Black home values were up 10.9% from the previous year, while white home values were up 9.7%. Back in February 2020, Black-owned home values were up 4.6% from a year earlier, while white home values were up 3.6%.

This helped to lower the overall home value gap between Black and white households to 15.9% from 16.7%.

But complicating the issue is the ability to save for a down payment. Based on median income data, it would take a Black household currently renting their home 14 years to save for a 5% down payment on a median priced home, the CRL report found. For a Latino renter household, it would take 11 years but for a typical white renter household, it would take 9 years.

"Homeownership is a key driver of wealth-building, but buying a home also requires wealth, which usually is tied to previous generational homeownership opportunities," said Nikitra Bailey, CRL executive vice president, in its press release. "This is a Catch-22 for Black and Latino communities, which have been denied homeownership through systemic discrimination epitomized by historic