Ginnie Mae is adding steps to its process for evaluating new issuers, including new notification requirements related to subservicer advances, servicing income, and borrowing facilities secured by mortgage servicing rights.

"These enhancements add to the factors Ginnie Mae will consider as we keep pace with an evolving mortgage market," said Michael Bright, Ginnie's executive vice president and chief operating officer, in a press release.

The new notifications reflect among other things nonbank issuers' growing use of

The changes also reflect the fact that Ginnie is bracing itself for what it anticipates will be a tougher economic cycle, and that it may have more bandwidth to monitor issuers now that the industry has consolidated and there is less of an application backlog.

Moreover, Ginnie has been increasingly focused on updating its policies to better size up nonbank risks, rather than the bank risks they were originally written to address.

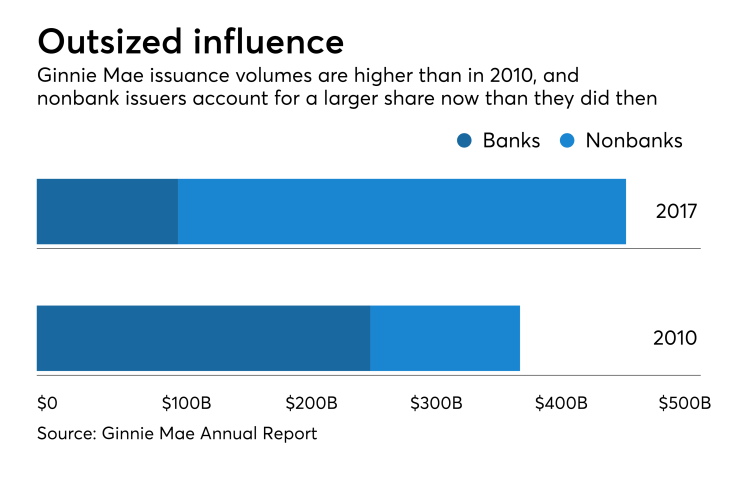

The nonbank share of Ginnie Mae issuers

Ginnie Mae, an arm of the Department of Housing and Urban Development that insures securitizations of Federal Housing Administration loans and other government-insured mortgage products, is working on several updates related to a