Until earlier this year, only one private mortgage insurer offered individualized rates based on granular, risk-based pricing. But that's quickly changing, with the other five PMI carriers all ramping up their own versions of "black box" pricing as they seek to make their products more competitive and efficient for lenders.

Genworth Mortgage Insurance will offer a risk-based pricing engine called GenRate beginning Dec. 10, while also continuing to offer its traditional rate card pricing. It joins Arch MI and National MI, which already offer the pricing technology. Meanwhile, the industry's other providers — Essent, MGIC and Radian — are all in varying stages of developing their own customized pricing.

"We found that there is indeed customer demand for more dynamic pricing capability in certain segments of the market," Genworth Mortgage Insurance President and CEO Rohit Gupta said in an interview. "Not in the mind of all lenders, but definitely there are segments of the market which are looking for more dynamic pricing."

Risk-based pricing is also known as black box pricing because rates are derived from proprietary algorithms that analyze a mortgage borrower's various risk characteristics. While more precise, it's also more opaque than traditional rate-card pricing, which groups borrowers into broader categories to determine their risk.

This shift in the PMI landscape comes at a critical time for lenders, as home purchases account for a larger share of overall shrinking originations. As affordability challenges from rising interest rates and home prices intensify, borrowers are likely to be more price-sensitive toward the ancillary costs associated with lower-down-payment mortgages, including PMI. Risk-based pricing on PMI may help lenders better compete for homebuyers with strong credit profiles, while rate-card pricing may lower costs for less creditworthy borrowers.

The technology that drives risk-based pricing also creates the opportunity for PMI carriers to make the process of ordering insurance policies more automated and efficient for lenders, much in the same way that Fannie Mae and Freddie Mac's automated underwriting systems streamlined the mortgage approval process.

In 2010,

It wasn't until this June that another insurer, National MI, would

"This is a very high rate of adoption just five months since our launch," she said. "Among the few who haven't adopted the platform, it is generally because they have a proprietary loan origination system and aren't yet able to operationalize it. We continue to work with those lenders to get them on the platform."

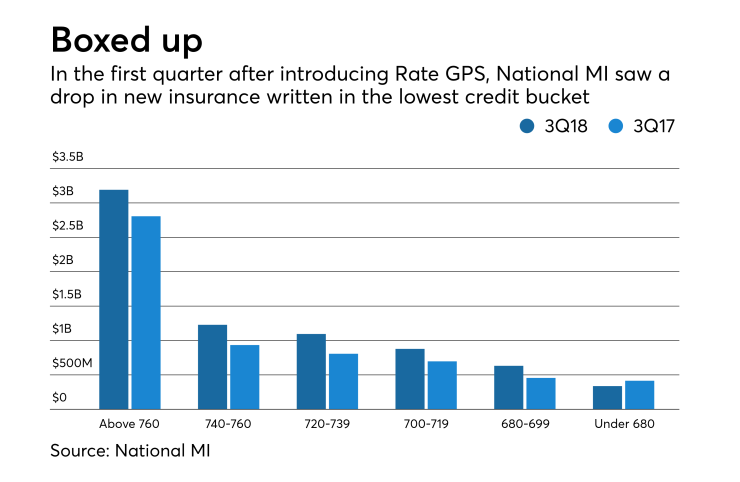

Rate GPS positively impacted National MI's third-quarter credit profile without sacrificing top-line growth, B. Riley FBR analyst Randy Binner said in a report. "We believe this implementation will allow National MI to be a step ahead of other PMI's in its shift toward granular, risk based pricing," Binner said.

Meanwhile, Radian delivers pricing electronically to its customers with varying levels of granularity.

"As we listen and talk to our customers, they all have unique and specific needs to accomplish their business strategies as it relates to our products. And so we're really positioning to keep our capabilities flexible and somewhat customizable to the customer based upon their needs verses us trying to force a one-size-fits-all solution on them," CEO Rick Thornberry said in an interview.

Radian uses its "proprietary analytics across risk and pricing and knowledge about our customers and we leverage those tools to really deliver loan-level pricing to our customers in a way that best meets their needs. And that can translate into different levels of granularity and different levels of transparency," he added.

The other two PMI carriers were not as specific about their plans, but it's clear the industry is heading in this direction.

"In terms of deploying the black box into the market, we have consistently said that we start with our customers," MGIC CEO Patrick Sinks said in prepared remarks during its third-quarter 2018 earnings call. "It is apparent to watch that the market is moving in this direction and we will be ready to compete regardless of how premiums are delivered. In terms of a broad market adoption, I see it to be a 2019 event."

In the meantime, he's not worried that MGIC will lose business to competitors that use black box pricing, Sinks told analysts on the call. "We're getting ready to introduce it to the market when the market calls for it. That's the most important thing. Our customers say, yes, you got to compete, we will be ready."

Essent Group Chairman and CEO Mark Casale, who

"While we do not see the entire lender space converting to more sophisticated pricing engines overnight, we do expect the trend to continue," he said during Essent's third-quarter earnings call.

Essent plans to roll out its version next year. The adoption of black box pricing will be driven by the customer and is more evolutionary than revolutionary, Casale went on to say.

"Lenders have to become comfortable with it from a compliance standpoint," he said. "This just doesn't happen overnight because the MIs roll out their pricing engine. I mean we don't drive the market, our lenders do."