Foreclosure activity continues to subside and most of the regulatory reforms created to protect distressed borrowers have been implemented. Yet mortgage servicers still haven't fully resolved the operational challenges facing their business. Why?

Servicers spent "so many years so focused on just getting through the day, they're finally in a position where they can do a post-mortem," said Marina Walsh, vice president of industry analysis in the Mortgage Bankers Association's research and economics department.

That's not to say servicers haven't been actively improving their operations, but it could be they have only recently had the bandwidth to address the big picture.

Servicers have had a succession of hurdles to overcome since the downturn. First there was the flood of distressed product during the crisis. Then there was a wave of enforcement actions and new rules that is just now beginning to end.

Even now, the

There is still a wide range of consumer satisfaction with individual servicers, but it is generally higher than it was when distressed loan volumes were at their peak between late 2007 and 2012, J.D. Power & Associates' annual customer service scores show.

The top servicers in the 2016 had scores approaching 900 on a scale of 1,000, suggesting that that the majority or about two-thirds of customers would definitely refinance with their servicer. The lowest had scores above but near 600, suggesting the majority of customers would switch servicers to get better customer service.

"In the heat of the distressed market that was where there was a lot of struggle, and not surprisingly the satisfaction was low," said Craig Martin, a director at J.D. Power. "Since that time we have seen pretty steady positive improvement within the servicer market."

While foreclosure volumes are at an 11-year low,

"The regulation had some positive impact [on customer service], but at the same time I think there is some drawback," he said. Servicers hadn't wanted to look too far outside fulfilling compliance requirements as a result, he said.

"I'm interested in seeing the next phase," he said. "It feels like for the first time we're getting out from the regulatory pressure."

Among the key areas servicers are still having problems with borrower communication and notification, including situations when there is a bankruptcy or escrow, or an improper modification denial, according to Joseph Rebella, a senior staff attorney at consumer law firm MFY Legal Services in New York.

"The industry as a whole has improved, but I wouldn't say each individual servicer has," he said.

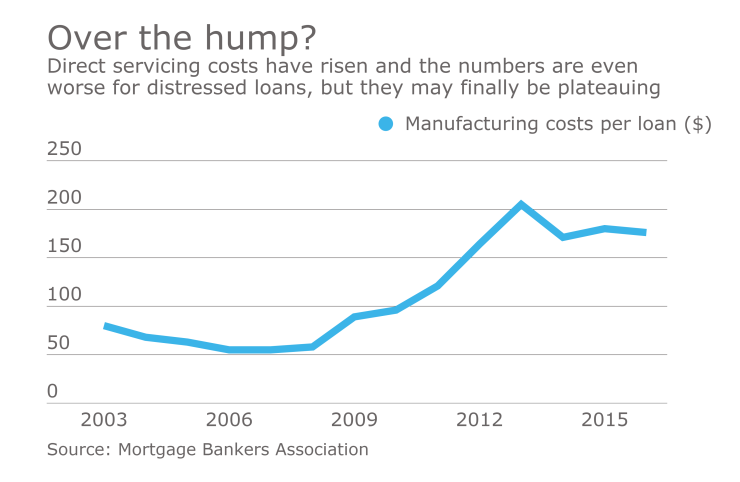

Part of this may reflect the run-up in per-loan servicing costs post-crisis and a

That makes mistakes understandable, but doesn't explain a lack of error resolution procedures that persists at many servicers, said Lisa Sitkin, a managing attorney at HERA, a nonprofit in the Oakland, Calif., area that works with consumers.

"These companies are going to make errors, but what galls me is the lack of accountability," she said.

The average distressed loan servicer might ultimately respond to borrower inquiries and documents submitted in support of modification applications, but servicers continue to need a lot of repeated prodding and multiples submissions, Sitkin finds.

Mortgage servicers are looking for ways to better communicate with distressed borrowers effectively and efficiently and increasingly are investing in technology to help them improve those communications in line with compliance requirements.

Nationstar, for example, late last year relaunched its website with new interfaces designed to help consumers more easily access information about what their options are if they can't make payments, including a mobile application.

"We're saying to current customers that we understand there are life situations, and we're here to help," said CEO Jay Bray.

The marks a big change from the past, when servicers preferred to divert distressed borrowers away from online communication into phone contact, said Martin. Some distressed borrowers eventually need phone contact, but they might want to research their options first.

To prioritize calls, among the technologies servicers are using is a voice response system capable of identifying voice tone in messages to the point where it can move voicemails with a more urgent tone to the front of a queue, said Walsh.

"Servicers are spending a lot of time, effort and money to get the customer contact right," Walsh said.

More of those kinds of borrower communication innovations could be coming down the road now that servicing rule implementation is almost done, she said.