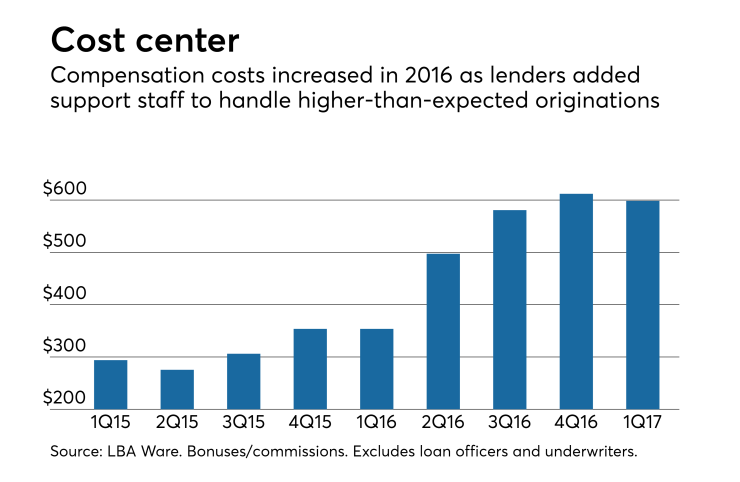

The bonuses lenders pay support staff for loans have skyrocketed — and there are no signs that it will normalize anytime soon.

Total bonuses paid to loan officer assistants, processors, closers and managers have nearly doubled in the past year, averaging $599 per loan in the first quarter, according to LBA Ware, a compensation technology vendor in Macon, Ga.

While the average represents a slight dip from the $612 in the fourth quarter, the number is expected to rise when LBA Ware releases data that takes into account stronger second-quarter production.

Compensation for support staff is "twice what it should be," said Rick Roque, a former retail production executive and managing director at Menlo Properties, a Winooski, Vt., consulting firm. Bonuses, for instance, averaged $354 average in the fourth quarter of 2015.

Support-staff bonuses have risen because it helps companies attract and retain loan officers. While compensation for loan officers is regulated by the Truth in Lending Act, lenders have more flexibility compensating support staff.

Loan officers value having support when they are trying to keep up in a high-volume market. Support staff also has more work to do when transitioning to a slower market with higher rates because they are originating more time-sensitive purchase-loans. Lenders have been through both markets recently.

"What makes this year different is you're coming off a very successful year," Roque said. "It's not just that production is down, but it's [down] after a year when production was really high."

More companies are willing to sell themselves after a high-volume year, which increases the importance of retaining the loan-production teams that buyers consider central to valuations.

"Consolidation may be what is really driving [bonus] appreciation," Roque said. "In 2016, most companies had a banner year and they want to sell their companies when their numbers look the best…This year is more active in [M&A] conversation than any probably since 2011."

When volumes are down, like they have been this year, it may seem counterproductive to spend more per loan because margins narrow as volumes and economies of scale decline. A company’s decision to sell changes that.

"During an acquisition, it's an unstable time, so you'll spend more on resources just to make [loan officers] feel better," Roque said.

Buyers may doubt that a lender’s numbers will remain high when volumes decline after a banner year, but sellers still feel the previous year's numbers give them a strong starting point for discussing valuations.

"The appraised value of a company is high right now," Roque said. "Buyers are pretty savvy about questioning that, but then there's negotiation."

Top producers that are central to companies' valuations may insist on a lot of support in this environment, and overall lender staff size

"If you get a strong high-producer, they can have a giant team," said Lori Brewer, LBA Ware's president.

Automation or market conditions could reverse the rise in support-staff spending.

"People

A long stretch of high rates or economic weakness could also make it hard for lenders to justify the expenses, relative to thinning margins on loans.

The net per-loan gain on mortgages originated in the first quarter was $224, down 61% from the fourth quarter and 73% from a year earlier, according to the Mortgage Bankers Association. Total spending on all personnel was $5,802 per loan on the first quarter, representing a 16% increase from the fourth quarter and a 13% rise from a year earlier.

"The market will normalize," Roque said, though he cautioned that it is unlikely to occur in the near term. "That cost per closed loan, per member of your team, is going to go down eventually."