The return to financial stability at Fannie Mae and Freddie Mac resolves a big problem from the past, but each government-sponsored enterprise must now turn to a task that will shape its future: picking a new CEO.

In contrast to a decade ago, when the Great Recession decimated their finances and government officials placed them into conservatorship, Fannie and Freddie are profitable. The leaders originally charged with restoring their profitability are stepping down because they consider their jobs done.

That leaves the GSEs to find CEOs who can lead them into a new phase, and attracting top-flight candidates may not be easy.

One hurdle to finding qualified candidates is that there is a $600,000

"The money is nothing to scoff at, but it seems like a paltry sum compared to what executives at investment or large, money-center banks command," said Tim Rood, chairman of the Collingwood Group.

Also, candidates for the two jobs must be

"I think the new CEO [at each company] is going to quickly be confronted with a

Egbert Perry, the chairman of Fannie's board, declined to discuss the specific parameters for Fannie’s CEO search that will occur over the next few months except to say that its next leader must be able to handle the new demands Fannie will face — and that includes satisfying the FHFA's performance and risk management goals.

"The first stage was: How did we get to conservatorship? The next stage was: Now that we understand what has happened and what's going on, let's figure out what we need to do to stabilize the organization," Perry said. "The third stage is: OK, the world around us is changing. How do we embrace that and try to move the organization into a place where it is still able to deliver on its mission?"

Fannie's current CEO, Tim Mayopoulos, "laid the foundation for the early phase of stage three," Perry said. The next CEO will take it from there.

The Fannie CEO job is a hard one, Mayopoulos acknowledged. The company is still in conservatorship and the focus of intense regulatory scrutiny, he said.

“There are still plenty of challenges, but the role the institution plays presents a real opportunity,” Mayopoulos said. “Housing is a good 15%-20% of the national economy and, so, to lead the biggest player in that market — setting standards and driving progress — is a great responsibility to have."

Whether either of the GSEs will choose an internal candidate to be the next CEO, like Fannie did when it moved Mayopoulos into the post, or whether either of the agencies will recruit an external one, like Freddie Mac did when it first hired current CEO Don Layton, remains to be seen.

Freddie says it is considering its new president,

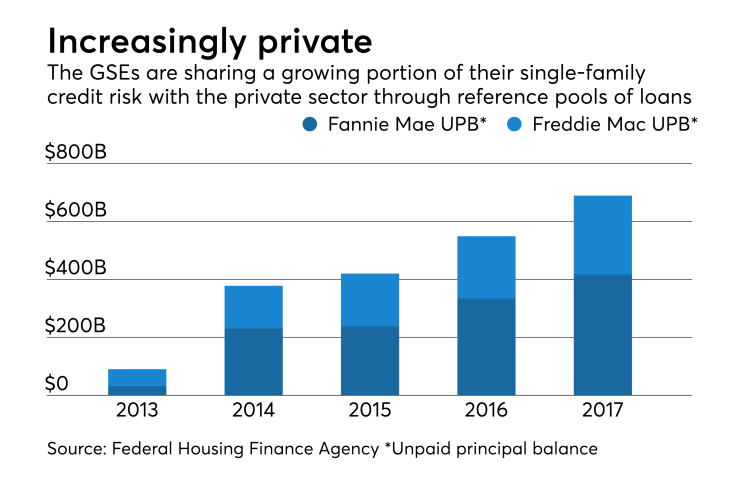

An internal candidate with a multifamily mortgage background like Brickman could be attractive to the GSEs. Some of the key financial instruments they have more recently used to shift single-family risk to the private sector resemble strategies used in the multifamily sector, said Willy Walker, chairman and CEO of the multifamily lender Walker & Dunlop.

But with presidents who were promoted from within already in place to take care of internal operations, the GSEs might be more likely to bring in a CEO from outside the company.

"They are really looking for a broader, visionary CEO," Walker said. "I would think they are looking more externally."

While there are a lot of challenges that limit the pool of candidates, there will be a pool of people interested in the two jobs, said David Battany, executive vice president of capital markets at Guild Mortgage.

"Despite all these issues, I think they still will get lots of people who will demonstrate an interest who are qualified, but it's not going to be like your typical search," he said. "It could be, for example, somebody who is maybe approaching retirement, and wants to end their career on a note where they are doing something for the public good."