The Federal Housing Finance Agency's move to

"I don't think the servicers are completely OK with what happened," said Walter Schmidt, senior vice president and manager of mortgage strategies at FHN Financial. "The worst-case scenario is that they would have been on the hook for all the advances, so this is helpful, but they didn't get the financing they wanted and the FHFA's statement didn't say what would happen after four months."

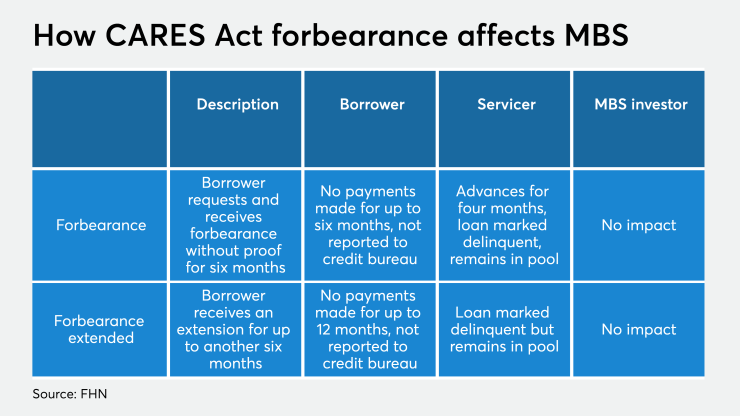

While the FHFA did specify that loans with forbearance would not be removed from pools in keeping with an exception made for natural disasters, the exact mechanism for how advances would be paid for and distributed at the end of the four-month period was not immediately clear.

In addition to uncertainty about how the FHFA will support advances for forborne P&I payments after four months, servicers still may have to figure out how to cover missing tax and insurance payments that are due in some instances. Under the Coronavirus Aid, Relief and Economic Security Act, borrowers can request and receive forbearance for up to a year.

While the Mortgage Bankers Association welcomed the FHFA's announcement of the advancing cap, President and CEO Robert Broeksmit noted that servicers would still need to bear these other burdens.

"This is an important step in reducing the maximum liquidity demands for servicers," said Broeksmit in a press release. "But servicers are still responsible for advancing payments for property taxes, homeowners insurance and mortgage insurance if the borrower does not pay them separately."

There has been a lot of speculation that other forms of government intervention could be used to provide additional support for T&I payments and liquidity if the FHFA agreed to take some responsibility for P&I payments. State regulators on Tuesday reiterated calls for federal officials to provide a financing facility to more broadly help servicers in response to the FHFA's announcement.

"FHFA's commitment to provide partial support to GSE mortgage servicers during this unimaginable national challenge is an important step, but only a first step," said John Ryan, president and CEO of the Conference of State Bank Supervisors. "State regulators maintain the call for the Federal Reserve and Treasury to establish a credit facility as a backstop to ensure servicers have access to predictable and reliable funding to avoid breakdowns in the mortgage finance system."