Wells Fargo notified 1,000 employees, including 900 mortgage lending professionals, that their jobs will soon be eliminated. It's the first major round of layoffs in a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

The decreases in the company's mortgage division "primarily reflect ongoing decreases in the number of customers in default" as well as "declines in application volume," spokesman Tom Goyda said in a statement.

The layoffs span Wells Fargo's Consumer Lending and Payments, Virtual Solutions and Innovations groups. In Des Moines, Iowa, where its home lending division is based, the bank will eliminate 400 jobs. Another 111 mortgage jobs will be cut in Fort Mill, S.C.

The Des Moines mortgage jobs are concentrated in the insurance/investor claims and default accounts payable groups, areas experiencing decreased workloads as foreclosure volumes fall. The volume of claims managed by this team is down 70% since the beginning of 2017, Goyda said in response to an emailed inquiry.

Those default servicing workers only received "prenotices," on Nov. 15 and won't receive 60-day notices layoff notices until next year. The remaining employees received 60-day notices on Thursday.

An unspecified number of the affected employees may be transferred to other positions within the company.

"We are committed to retaining as many team members as possible and will do everything we can to help them identify other opportunities within Wells Fargo," Goyda said in the statement.

The company is planning to cut costs in response to compliance expenses, as well as fluctuations in volume, by reducing its total staff of 265,000 by 5% to 10% in the next three years, CEO Tim Sloan said

Banks and

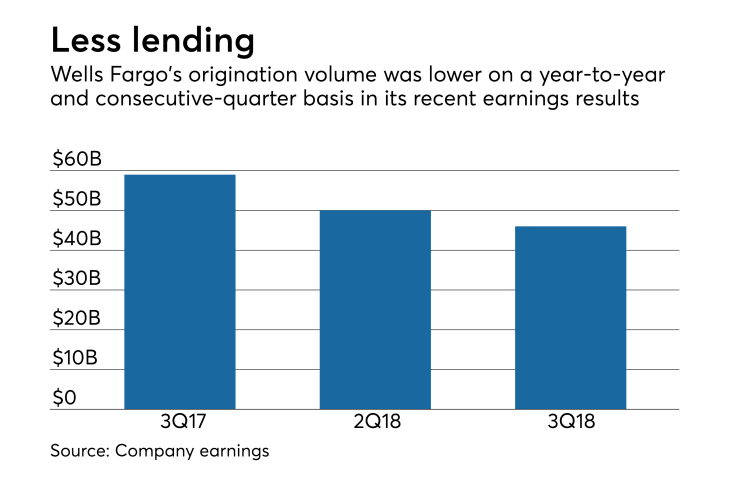

Wells generated $46 billion in residential mortgage originations in

Its mortgage banking noninterest income during the period was $846 million, down from $1 billion a year earlier but up from$770 million in the second quarter. It attributed the consecutive-quarter increase to relative improvement in the production margin on residential-mortgage originations held for sale.