Federal regulators and mortgage lenders were "largely responsible" for the housing and mortgage crisis, which should be remedied by better enforcement of predatory-lending statutes and the adoption of "suitability" requirements and federal licensing standards for lenders, according to a white paper by Weiss Research Inc.The white paper, submitted to the Federal Reserve Board July 19, argues that the crisis is likely to worsen and that the Fed played a role in "further inflating the housing bubble that's at the root of the current crisis." Mike Larson, Weiss's interest rate and real estate analyst and the author of the report, also points the finger at lenders who "debased their standards" rather than accept a decline in lending volume, and at Wall Street, whose "large-scale transformation of mortgages into securities significantly boosted risk-taking." Among other things, the report calls for assignee liability for the secondary market and closer monitoring and prompter action by the Fed to "help avert runaway asset price inflation." Weiss, based in Jupiter, Fla., can be found online at http://www.weissgroupinc.com.

-

The mortgage broker trade group put out a white paper calling for lowering transaction costs, increasing housing supply and reducing regulatory barriers.

February 13 -

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

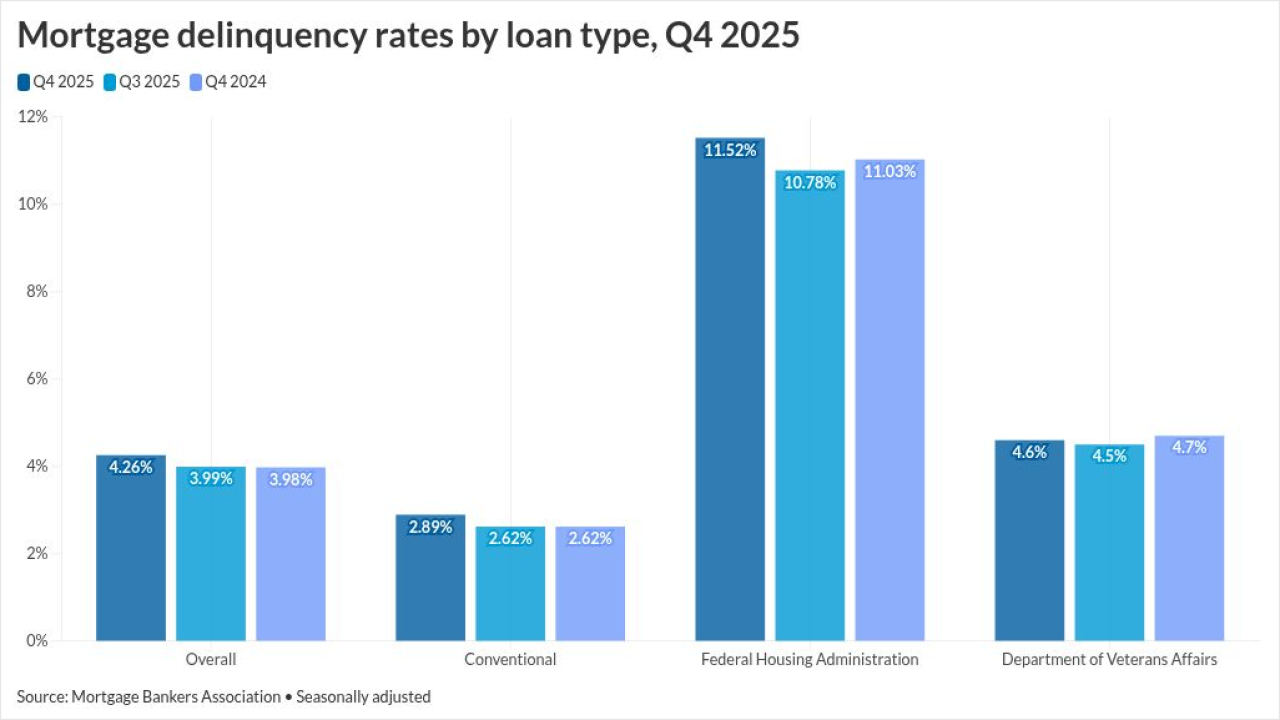

Mortgage delinquencies increased across loan types, and while 30-day late payments showed overall improvement, later-stage distress worsened.

February 13 -

The Bureau of Labor Statistics released its January Consumer Price Index Friday, showing that inflation rose 0.2%, while the annual rate eased to 2.4% after holding at 2.7% for several months. The data reduces the likelihood that the Federal Reserve will cut interest rates in the near future.

February 13 -

Hundreds of E Mortgage Capital employees, including loan officers, can opt-in to the complaint accusing the company of failing to pay them for overtime.

February 13 -

The Consumer Financial Protection Bureau's complaint portal has been flooded in recent years, but corporate debt collectors, industry attorneys and consumer advocates question whether the bureau's efforts to reduce the volume will help consumers as much as it helps the firms they're complaining about.

February 13