The impending bankruptcy of Walter Investment Management Corp. should not affect its subsidiary Ditech Financial's capability to service securitized mortgages, Fitch Ratings said.

Walter should file

Fitch does not rate Ditech as a residential mortgage servicer, but the rating agency said in a press release that it had discussions with the company regarding the planned bankruptcy filing because of Ditech's participation in residential mortgage-backed securities.

Liquidity is not expected to be an issue as Walter has stated that the company has sufficient funds to support its businesses and the costs of the restructuring.

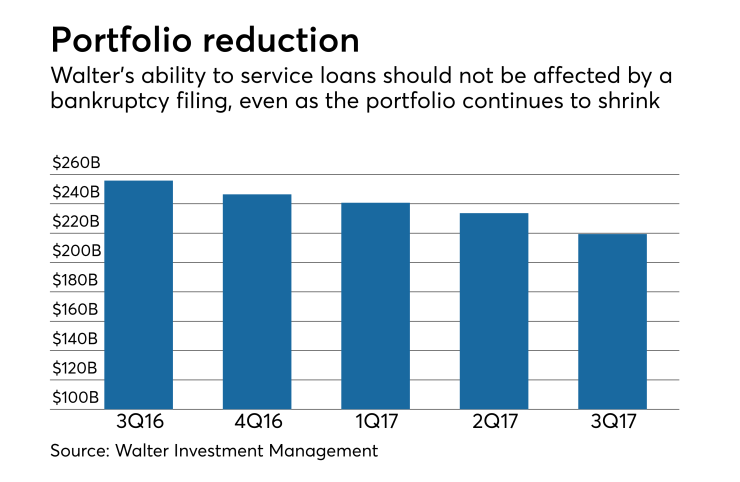

As of Sept. 30, 2017, Ditech serviced 1.7 million forward mortgage loans with an unpaid principal balance of $199.6 billion. RMS serviced 109,153 reverse mortgage loans with an unpaid principal balance of $19.8 billion.

Walter had a $253.8 billion servicing portfolio at the end of the third quarter of 2016.

Back in July, Walter notified employees

Fitch currently has outstanding ratings on approximately 225 bonds backed by mortgages serviced by Ditech. Of these, more than 100 of those bonds hold distressed ratings, but roughly 90 are considered to be investment grade.

"Based on available information, near-term expectations are that U.S. RMBS bonds serviced by Ditech will not be subject to servicer disruption and the bond credit risk will likely remain unaffected," Fitch said.