Walter Investment Management Corp. is looking to file for

The company started soliciting approvals on Nov. 6 for the prepackaged bankruptcy plan from its debtholders that were parties to restructuring support agreements.

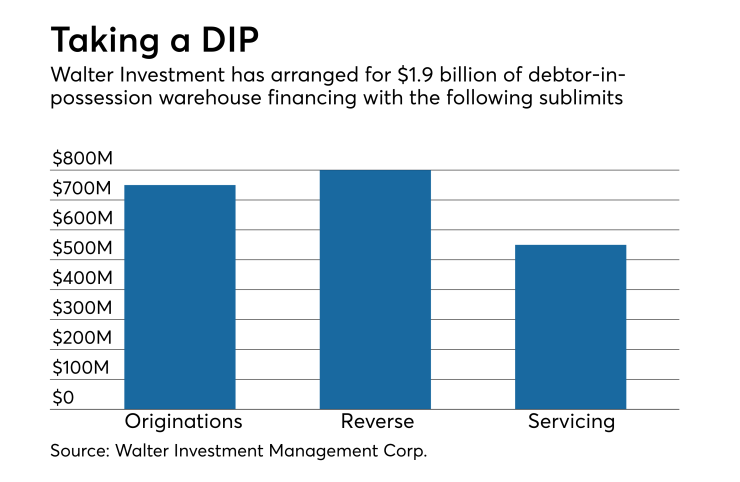

Up to $750 million of the DIP funding can be used for Ditech Financial's loan originations. There is $550 million available to finance servicing advances; this can be increased to $600 million if some of the current servicing advance credit lines are not available to Ditech after the bankruptcy filing. An additional $800 million will be available to the reverse mortgage business.

Only the holding company will file under Chapter 11. Neither Ditech nor RMS is expected to file for bankruptcy.

For the second consecutive period, there is a statement in the 10-Q filing declaring that there's

The DIP funds will be provided by Credit Suisse First Boston Mortgage Capital, as the structuring agent, lead arranger, co-lender and administrative agent. The other co-lenders are Credit Suisse AG Cayman Islands Branch and Barclays Bank.

"We expect our business operations to continue as normal during the execution phase of our financial restructuring, and we expect to emerge from this process as a stronger company that is better positioned to serve our customers," CEO and President Anthony Renzi said in a statement.

Walter lost $124.1 million in the third quarter, which is an improvement over a restated $213.3 million loss one year ago.

This quarter Walter recorded a fair value charge of $70.5 million on changes in valuation inputs for its servicing portfolio.

There was a pretax loss of $49.3 million in the other non-reportable segment, an increase of $24.1 million over a year ago, because of expenses related to Walter's debt restructuring.

The servicing segment had a pretax loss of $69.2 million, compared with a pretax loss of $161.6 million last year. Servicing revenue decreased by $58.4 million year-over-year to $90.5 million. As of Sept. 30, Ditech serviced $199.6 billion of mortgages, down from $235 billion one year prior.

Ditech had $3.7 billion of mortgage originations, compared with $5.3 billion one year ago. Its pretax income of $19.9 billion was down by $31.8 billion from the third quarter of 2016. The net gain on sale was down by $50.3 million as production shifted from the higher margin direct-to-consumer channel to lower margin wholesale and correspondent channels.

Reverse mortgages had a $24.9 million pretax loss, compared with a $23 million pretax loss one year prior.