Millennial homebuyers have become more likely to use savings from their primary paychecks to fund down payments as

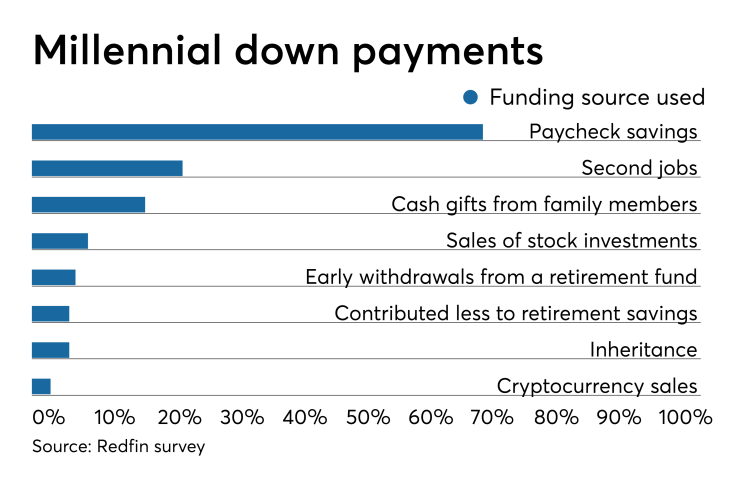

Almost three-quarters or 72% of respondents used earnings from their main job as a down payment source, according to the March survey by Redfin. A year earlier, the share of respondents identifying their primary paychecks as a source of down payment funds was 3 percentage points lower at 69%.

The percentage of consumers that used other sources of cash to put money down on a home was lower in every other category this year.

The steepest drop was in the percentage of millennials that used earnings from secondary jobs to fund down payments. Only 24% used this source of cash, as opposed to 36% the previous year.

The share of millennials that used cryptocurrency sales to fund down payments also has fallen, possibly in response to Bitcoin's drop in value late last year. Just 3% of millennials used cryptocurrency to help fund their down payments in the most recent survey, comped to 10% the previous year.

Sales of stocks, which declined in value late last year, also were used by a smaller share of millennials to fund down payments. Almost 10% of respondents sold stock to put money down on homes, as opposed to 13% in the last survey.

The percentage of millennial borrowers who received cash gifts from their families fell to 6 percentage points to 18%, and those that reported receiving an inheritance they could use to help pay for their down payment fell 6 percentage points to 6%.

Fewer also dipped into or withheld money from their retirement savings in order to fund a down payment. The share that contributed less to retirement savings fell 6 percentage points to 12%, and the share that pulled money from a retirement fund early was down by 6 percentage points at 7%.

Redfin's findings are based on the responses of more than 500 people surveyed who are part of the millennial generation. In total, Redfin surveyed 2,000 U.S. residents with plans to buy a home in the coming year.