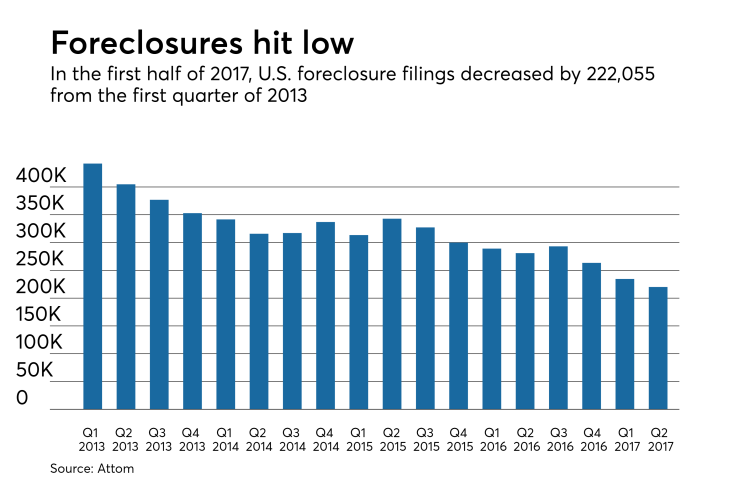

There were 424,800 U.S. properties with foreclosure filings in the first half of 2017, down 20% from the prior year, according to Attom Data Solutions. Foreclosed properties are being purchased by third parties at record numbers.

The foreclosure filings include default notices, scheduled actions and bank repossessions, and are down even more from two years ago, when filings were 28% higher.

Seven states contradicted the national trend and faced an increase in foreclosure activity during the first half of the year, including Mississippi, with an 11% increase, Louisiana, a 5% increase, and Connecticut, up 3%.

"With a few local market exceptions, foreclosures have become the unicorns of the housing market: hard to find but highly sought after," said Daren Blomquist, senior vice president of Attom Data Solutions, in a press release.

In the first six months of 2017, 38.3% of properties that sold at foreclosure auction went to third-party buyers rather than banks. That is up 26.9% since last year, and it is at the highest level since 2000, the earliest this data is available.

"Although foreclosures are fading overall, there has been a notable uptick in foreclosures completed by some nonbank entities, counter to the sharp downward foreclosure trend among big banks and government-backed loans," Blomquist said.

"These divergent foreclosure trends are likely the result of the big banks and government agencies selling off distressed loans over the past few years to nonbank entities that are now foreclosing on an increasing volume of that deferred distress."

Among 183 metropolitan statistical areas, Reno, Nev., had the highest share of completed foreclosures sold to third-party buyers, with 80.6%.

Starting from the first public notice, it took an average of 883 days to complete the foreclosure process in the second quarter of 2017, compared to 814 days in the first quarter. This time a year ago, the process took an average of 631 days.