United Wholesale Mortgage's servicing customers might be able to make their monthly payments in digital currency, Chairman and CEO Mat Ishbia said on the company's third quarter earnings call.

"We've evaluated the feasibility and we're looking forward to being the first mortgage company in America to accept cryptocurrency to satisfy mortgage payments," Ishbia said. "That's something we were working on, we're excited to hopefully in Q3 we can actually execute on that before anyone in the country, because we are a leader in technology and innovation."

The United States lags behind other countries when it comes to this type of digital payment. For example, in July, a bill was introduced in Spain that would

Ishbia did not discuss on the call what type of cryptocurrency UWM would accept given that the project still is in the early stages. But in a published report, he said it probably would be Bitcoin first, plus the company is looking into others as well.

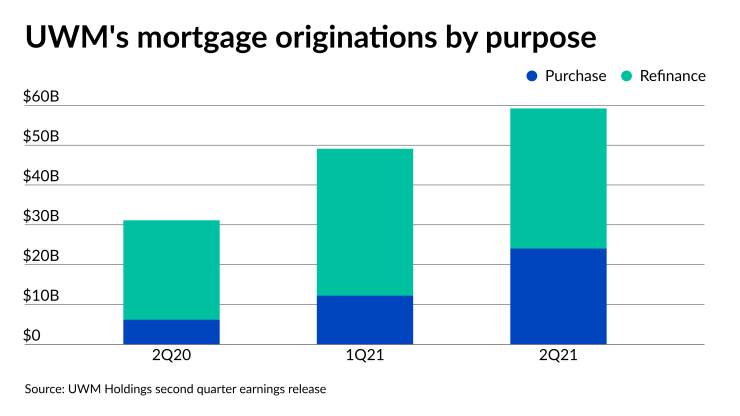

Addressing the company's second quarter results, he noted that the change in purchase volume, not in origination share mix, is how investors should evaluate a mortgage company.

"It's important to know that purchase mix can solely change by doing less refinance, and that's really not the story we're trying to tell, we're trying to talk about the strength of our business," Ishbia said.

That is why the second quarter, when the average mortgage rate rose to 2.99% from 2.8%, was a glimpse into the future. "So, just about a 19 basis point rise in the rates, and you'd thought the whole industry shut down based on how a lot of people reacted," Ishbia said. "Wait until it goes from 2.99 to 4%, and you'll see the strength of our business across the board."

Even though UWM's gain on sale margin for the second quarter was

For the third quarter, UWM expects to originate between $52 billion to $57 billion in total volume with a margin between 75 bps and 100 bps.

UWM brought

The "nice part," he added, was that purchases comprised more than half of the volume from this product at $3.2 billion, compared to $2.7 billion in refis.

Jumbo products also contributed to the company’s increase in second-quarter interest income, which rose to $79.2 million from $45.9 million in the previous fiscal period.