Editor's note: This is the third in a three-part series from the July issue of National Mortgage News magazine on United Wholesale Mortgage. Read

United Wholesale Mortgage became the largest player in its loan channel by going a step further than its peers in anything it offers brokers.

But competition is making it tougher to stay ahead of the curve.

While UWM been one of the few players to extend the kind of newer and more innovative technologies used in more commonly in the retail or consumer direct channels to brokers as well as provide more operational support, it hasn't been alone. Fintech companies like Newfi also have done this.

So in addition to giving brokers access to new operational strategies that didn't exist before the crisis,

Among other things, United Wholesale Mortgage CEO Mat Ishbia is known for participating in a video promoting a movement called

BRAWL is separate from AIME and its main agenda is to put pressure on multichannel "retail-wholesale" lenders if their retail channel competes for wholesale borrowers' business, according to Casa. BRAWL rates lenders based on this.

But rather than being a promotional tool for UWM, BRAWL is probably a liability, said Casa. It "showed everybody the roadmap" to addressing a key concern for mortgage brokers, making the market more accessible to entrants unfamiliar with it, he said.

"BRAWL has actually has hurt my business," Ishbia said. "It's made it so everyone else has learned the things I've been doing for years. Now my competition sees my playbook and is trying to rebuild it, or some of them will."

Being able to keep innovating quickly enough may be what makes or breaks UWM, and it may be getting tougher to keep up with the competition in certain areas, said Casa.

UWM is taking even more steps to

The company, for example, plans to discontinue its internal, employees-only retail channel in favor of its employees working with brokers — even if that means a broker pairs a UWM employee with another wholesaler.

"We said, 'Hey, all of our team members internally, we could fund your loan, but we'd rather you work with a broker. We're not the right place. Even though you work for our company, work with one of our local brokers, and our local brokers will use us or one of my competitors. Whatever is best for the consumer,'" Ishbia said. "I really believe in brokers that much that I want them to originate my own team members' loans."

UWM services most of the loans it funds and after closing, broker's name appears on servicing statements as the borrower's contact for refinance or new loan inquiries. When it does sell servicing rights on seasoned loans, it takes measures to help brokers stay connected with borrowers by requiring the new servicer to sign nonsolicitation agreements that are in effect for one to three years.

The move is not without its downsides for UWM. The nonsolicitation agreements are hard to enforce and could potentially affect mortgage servicing rights pricing. But the agreements have so far been respected and Ishbia said they're worth their weight in relationship building with brokers.

"There are people that won't buy our servicing because of it and that's OK. People could pay me a little worse price because of it, potentially. It's OK," Ishbia said.

And the strategy stands to become a more significant distinction between UWM and depositories that are often motivated to do offer wholesale lending by the opportunity to solicit and cross-sell borrowers.

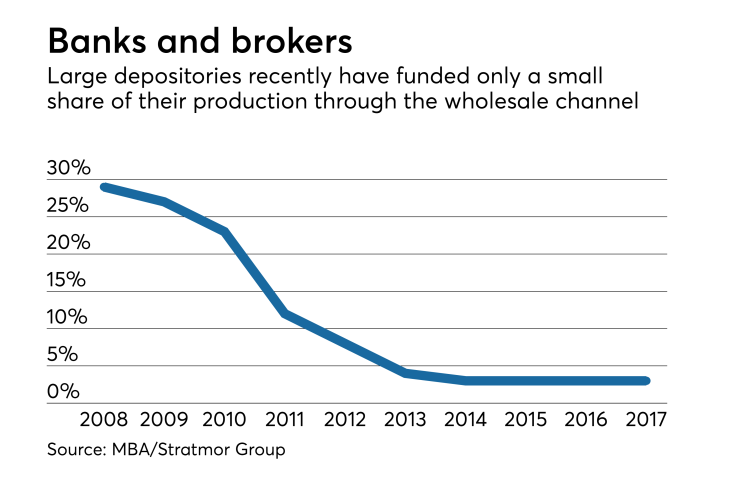

But so far, banks are still largely staying clear of the wholesale lending. The channel represents only 3% of large banks' origination volume, according to the Mortgage Bankers Association and Stratmor Group. But that's starting to change for at least some institutions. Citizens Bank, for example, recently

"The economics make a lot of sense for banks. The tricky part is the regulatory pressure. Brokers are independent contractors. You can have rules, you can have guidance, but it's very hard to manage the risk," said Garth Graham, senior partner at Stratmor Group.

While wholesale is getting a lot of attention among lenders with aspirations to grow, "I don't know that it will be in six months," said A.W. Pickel III, an industry veteran and the

"Smaller, lightly-capitalized mortgage bankers are going to willing to take their capital off the table, or they are going sell out to larger players."

— Garth Graham, senior partner at Stratmor Group

Indeed, some lenders are experimenting with wholesale and then later finding that they are "not sure they want to be in the business," said Tyler House, manager of advisory services at mortgage industry consultancy Richey May.

For now, though, prospects for wholesale look strong.

"We believe the market consolidation is going to result in a few things: smaller, lightly-capitalized mortgage bankers are going to willing to take their capital off the table, or they are going sell out to larger players, and I think some of the big aggregators are looking at the wholesale channel and saying, 'I like the variable cost model,'" said Graham.

Ultimately, the increased competition won't be easy for UWM to contend with, but Ishbia does see an upside.

"It's not about UWM thriving, it's about the channel thriving, and if the channel thrives, UWM will thrive," he said.

What's more, an influx of competitors will help UWM and Ishbia stay on their toes.

"There's no guarantee that UWM stays at a 20% market share. We have to earn it every single day," he said. "In retail, you can make a mistake and kind of get all your business back. Brokers, they don't have to work with me tomorrow. I have to be great every day and if I'm not great every day, they go elsewhere."