Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

"Nationally, defect risk continued to surge in early 2019 and in February reached its highest point since 2013," Mark Fleming, First American's chief economist, said in a press release. "Suddenly in March, the acceleration stopped. Two recent trends influenced defect risk in opposite directions and drove the moderation in defect risk."

On one hand, seller's market conditions increased the risk for mortgage application defects, but at the same time, growth in the percentage of lower-risk refinances lowered the potential for fraud.

After hitting a 2018 high of 4.9% in November, mortgage rates changed direction and have been declining since. The growing incentive to refi pushed up the share of refinance transactions in the first quarter to 32%, a 5% increase from the same period a year ago.

Though defects on a mortgage application can occur regardless of loan type, there is a lower propensity for fraud with refinance transactions, according to Fleming.

Mortgage rates also affected conditions for mortgage sellers, though these impacts had the opposite effects on risk.

"While declining mortgage rates spurred refinance activity, they've also encouraged potential homebuyers to return to the market. In the first quarter of 2019, declining mortgage rates, ongoing household income growth and moderating unadjusted home prices boosted affordability," said Fleming.

"Yet, the increased demand for housing is occurring in a supply-constrained market, resulting in another seller's market this spring. In these competitive conditions, there is more motivation to misrepresent information on a loan application to qualify for the bigger mortgage necessary to win the bidding war for a home. In fact, employment misrepresentation increased 2.9% compared with the previous month," he continued.

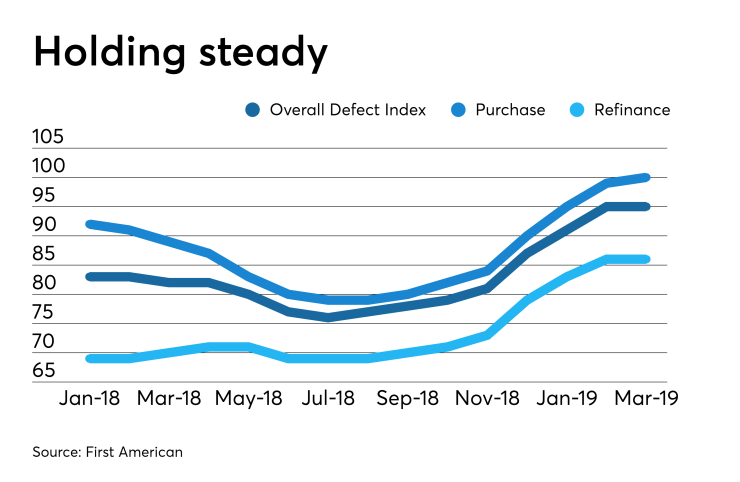

The frequency of defects, fraudulence and misrepresentation in information submitted on mortgage applications leaped 15.9% year-over-year in March, but remained unchanged compared to the previous month, according to First American's Defect Index. The index reading for March was 95.

The Defect Index is benchmarked so that a value of 100 represents conditions in January 2011, so all changes can be interpreted as a percentage change in defect frequency relative to that time period. A higher value suggests a rising level of loan application defects.