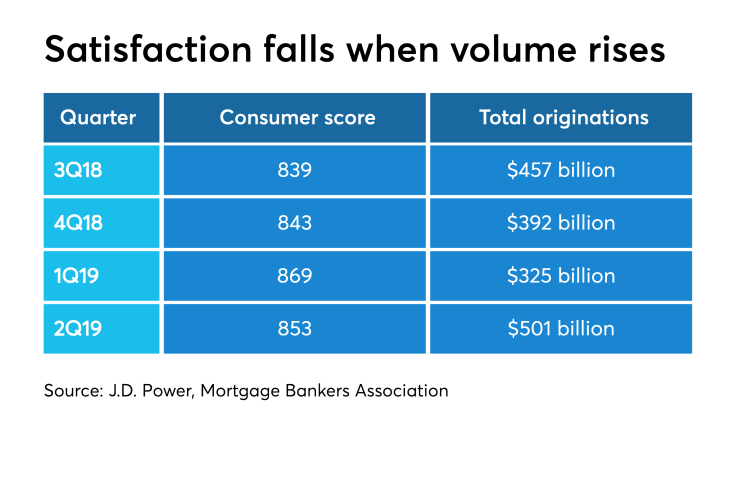

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

"When there's a volume increase, whether it's purchase or refinance, it tends to negatively affect satisfaction because lenders have a hard time scaling up their staffing and process quickly to handle the influx," said John Cabell, director of wealth and lending intelligence at J.D. Power.

Overall satisfaction for the four quarters ended on June 30 was actually higher than that one year prior, with an industry average of 850 versus 836 in

However, as average mortgage rates

Purchase activity also increased during this year's second quarter, but at a lower percentage relative to refis. Going forward, home purchase volume is

Even as volume increased, mortgage industry employment also was on the upswing, but the most

As a result, the overall customer satisfaction score fell to 853 in the second quarter from 869 in first quarter. There was a higher decline among customers buying a home than among those refinancing; J.D. Power does not release separate satisfaction scores by loan purpose.

The score for last year's third quarter — the three months with the most volume in 2018 according to the Mortgage Bankers Association — was 839. The fourth quarter of 2018 — where there were more originations than in the first quarter this year — had an 843 score.

The survey found borrowers still communicate with their lenders via email (70%) and telephone (63%). Only 15% said they used the lender's mobile app.

Still, consumers want real-time online updates on their loan status. The overall satisfaction scores average 140 points higher when lenders provide customers' access via an online portal for that purpose compared with lenders that don't provide such capability.

"It's a slow evolution, we're seeing more usage of digital channels, but it's still largely on email and phone that a lot of the business happens for mortgage originators and so lenders don't have an opportunity to use those more flexible self-service channels in greater quantity for the right types of transactional steps," Cabell said. Digital gets the best response for things like uploading documents and status updates for now.

This year's results show that volume tops digital as a driver of positive or negative customer satisfaction ratings.

When it comes to individual company results, Quicken Loans extended its streak to 10 years as the lender with the highest origination satisfaction score, at 880, up four points from last year. Fairway Independent Mortgage remained second, but its score of 865 fell eight points from the 2018 survey. Guild Mortgage placed third at 864, a seven point increase.

However, three companies — Navy Federal Credit Union, USAA and Veterans United — all scored higher than Quicken but because they serve a limited market, were not ranked.

Meanwhile BB&T, which is

Flagstar finished 19th with a 798 score and Freedom Mortgage was 18th at 803.

Last year's lowest scoring company, U.S. Bank, moved all the way up to sixth this year, taking its score to 852 from 785.

The survey required a certain number of consumer responses to be submitted for a company in order for it to receive a score.