Title insurance volume and operating income both increased year-over-year in the third quarter, as a dip in mortgage rates late in the period spurred application activity, the American Land Title Association found.

Premiums written during the third quarter totaled $4.3 billion. That is a 5.3% gain compared with $4.1 billion for the second quarter, as well as for the third quarter of 2023.

Meanwhile in a period where

But at the same time, operating expenses, along with loss and loss adjustment expenses rose by 6.1%.

That balances out to a total operating gain of $199.2 million for the period ended Sept. 30. This compares with $323.5 million of total operating gain for the third quarter of 2023, a decrease of 17.6%.

"Results of the latest quarter reflect headwinds from continued elevated interest rates and limited housing supply that have hampered volume for home sales and mortgage refinances for more than a year," Diane Tomb, ALTA's chief executive, said in a press release.

Through the first nine months of this year, premium volume was up 3.2% to $11.8 billion. Claims paid,

"While the housing market is slowly climbing out of a cyclical downturn, ALTA members will continue to deliver a valuable service and insurance product," Tomb said. "Title insurance is the best option to reduce risk and protect property rights for consumers and lenders."

By individual underwriter, First American Title retained its No. 1 market share position, doing 21.9%.

But Fidelity National Financial again placed three of its units in the top 10, which when combined did more business than First American: Fidelity National Title, 14%; Chicago Title, 13.5%; and Commonwealth Land Title, 3.3%.

The largest underwriting units of the other big four players, Old Republic National Title Insurance and Stewart Title Guaranty, did 14.5% and 9.3% respectively.

The largest independent underwriter remains Westcor Land Title. But the company whose

Title Resources Group completed its acquisition of Doma near the end of the quarter. For the period, Title Resources Guaranty had a 3%, while Doma, which earlier sold its direct operations, ranked 10th at 1.7%. On a pro forma basis that would make TRG the largest of the independent players.

However, social media and

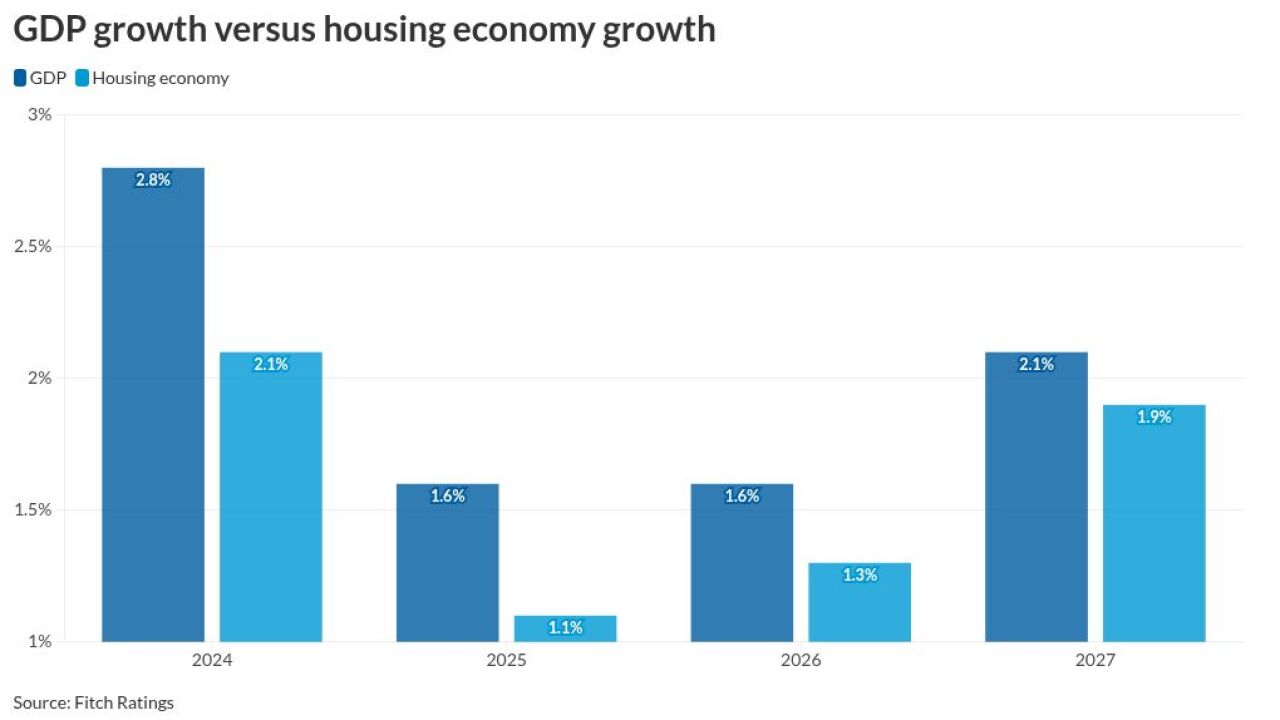

For 2025, a report from Fitch Ratings predicts

But its outlook is neutral for the industry as the housing and mortgage markets are still expected to be dealing with the difficulties they have experienced in the post-pandemic years, although to a lesser degree.