The mortgage delinquency rate reached its lowest point in nearly a decade in May due to tighter underwriting, according to CoreLogic. Also improving mortgage performance were employment growth and rising home prices.

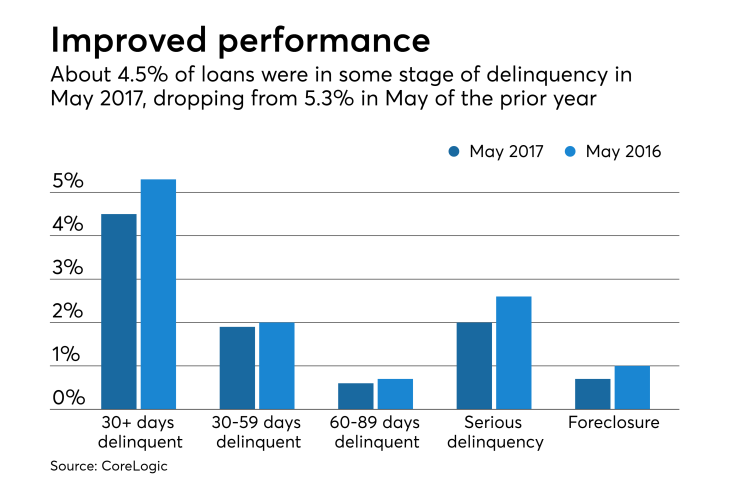

About 4.5% of mortgages were in some stage of delinquency in May, a decline of 0.8 percentage point from the previous year when the overall delinquency rate was 5.3%. The serious delinquency rate in May remained unchanged from

Frank Martell, CoreLogic president and CEO, credits underwriting practices for the delinquency rate improvements.

"A prolonged period of relatively tight underwriting criteria has driven delinquencies down to pre-crisis levels across many parts of the country," said Martell in a press release. "As pressure to relax underwriting standards increases, the industry needs to proceed carefully and take progressive, sensible actions that protect hard-fought improvements in mortgage performance."

Early-stage delinquencies, defined as 30-59 days past due, declined from 2% in May 2016 to 1.9% in May of this year. The share of mortgages that transitioned from current to 30 days past due also declined 0.1 percentage point from May 2016.

"Strong employment growth and home price increases have contributed to improved mortgage performance," said Frank Nothaft, chief economist for CoreLogic, in a press release. "Early-stage delinquencies are hovering around 17-year lows, and the current-to-30-day past-due transition rate remained low at 0.8%."

"However, the same positive economic conditions helping performance have also contributed to a lack of affordable supply, creating challenges for homebuyers," he added.

In May,