WASHINGTON — Adolfo Marzol, a top official at the Department of Housing and Urban Development, is optimistic that technological improvements and other changes can help draw Federal Housing Administration lenders back to the fold.

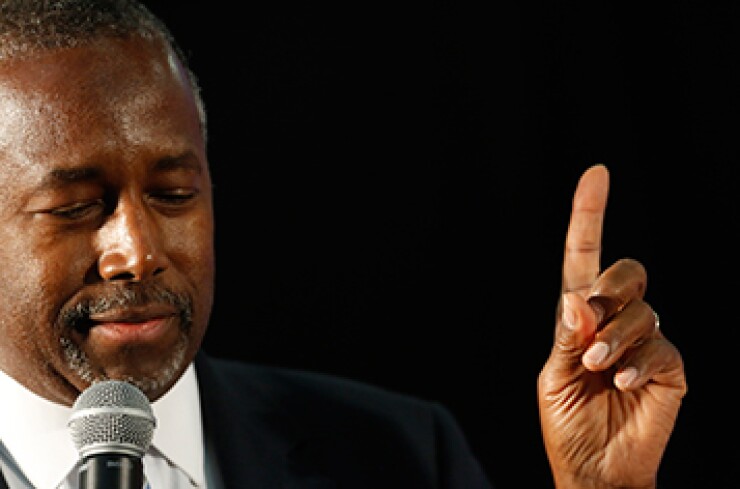

The senior adviser to HUD Secretary Ben Carson, Marzol worked at Fannie Mae from 1996 to 2005. He said that although the FHA has a $1.2 trillion book of business, the technology gap between it and Fannie is “dramatic.”

“One thing we can all agree on is no matter what reforms happen, we do have to have a strategy for funding the technology needs of FHA," he said at an Urban Institute housing event this week. “I want to be a very strong voice for technology modernization.”

Marzol said he is hoping that once Brian Montgomery, the Trump administration’s nominee to head FHA, is confirmed, he could help accelerate the issue.

He also noted that the agency has received significant feedback from lenders regarding FHA loan certifications, loss mitigation, servicing and loan conveyance requirements.

"We believe in improving all of that," Marzol said. "Secretary Carson has been very clear that he does not want lenders to be afraid of using FHA.”

Fears of a large penalty under the False Claims Act remain an issue, one that HUD is tackling. Nonbank lenders account for 82% of FHA originations today, up from 38% in 2013, in part because of bankers’ worries about legal claims.

"When we have made that progress, I am very confident will be able to have very good dialogue with the whole enforcement community so that lenders won’t shy away from doing business with FHA and serving FHA borrowers for reasons that don’t make sense,” Marzol said.

Barry Zigas, director of housing policy Consumer Federation of America, is optimistic about the FHA’s efforts.

"Getting this right is very important to consumers," Zigas said. "I don’t think you can have something as important as FHA mortgage insurance, which I view as a critical part of mortgage access particularly for low-wealth borrowers, if lenders won’t depend on it and lenders won't fully use its flexibilities.”

The FHA's serious-delinquency rate for single-family mortgages is 3.8%, compared with 1% for Fannie Mae and Freddie Mac loans, according to Urban Institute data. FHA delinquency rates are well below their 2005-2006 levels.

Some industry representatives are hopeful that HUD’s efforts will coax bankers back to the FHA.

"We worry about a nonbank share that is too large because it makes the government market more procyclical — expanding when times are good and contracting when times are bad," said Laurie Goodman, a co-director of the Urban Institute’s Housing Finance Policy Center.

It also makes "FHA lender oversight much more challenging," she added, because many nonbank lenders tend to be smaller, thinly capitalized entities, which don’t have a prudential federal regulator.

Analysts said changes to certification clarifications and a new loan defect taxonomy will have an impact.

“These changes, once finalized, should modestly lessen lingering legal liability concerns for FHA lenders," Compass Point analysts Isaac Boltansky and Lukas Davaz said in a recent client report.

"We caution, however, that lenders are unlikely to materially shift strategy based solely on administrative changes as the FCA has a 10-year statute of limitations and is therefore subject to changes in the political winds.”