With the launch of its Medical Professional Mortgage Product, TD Bank is leveraging an opportunity to attract new customers and to address what it says is a knowledge gap among this group of professionals.

Less than one in five medical students are aware of mortgage offerings for their field, and nearly a quarter of those who are in practice claim student debt made buying a house more challenging, according to TD Bank.

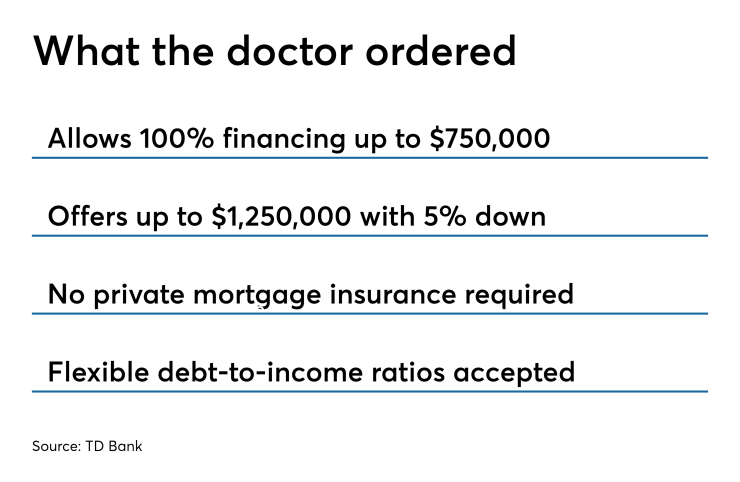

The bank's new product, available to physicians, dentists, fellows and third-year students, offers the ability to secure 100% financing with a maximum loan amount of $750,000 and does not require private mortgage insurance. Applicants wanting to borrow up to $1.25 million will only make a 5% down payment.

TD Bank's Medical Professional Mortgage Product is available in both fixed- and adjustable-rate options. Flexible debt-to income ratios are also accepted, depending on income, according to the bank.

The product "alleviates some of the biggest challenges those in the medical field face following graduation and residency, such as large amounts of debt and a lack of earning history," Rick Bechtel, TD Bank's head of residential lending, said in a press release.

The move by TD Bank to tap the health care market highlights a trend of mortgage institutions creating specialized programs for professional groups like doctors, community workers and law enforcement.

Similarly, TransPecos Banks in Pecos, Texas,