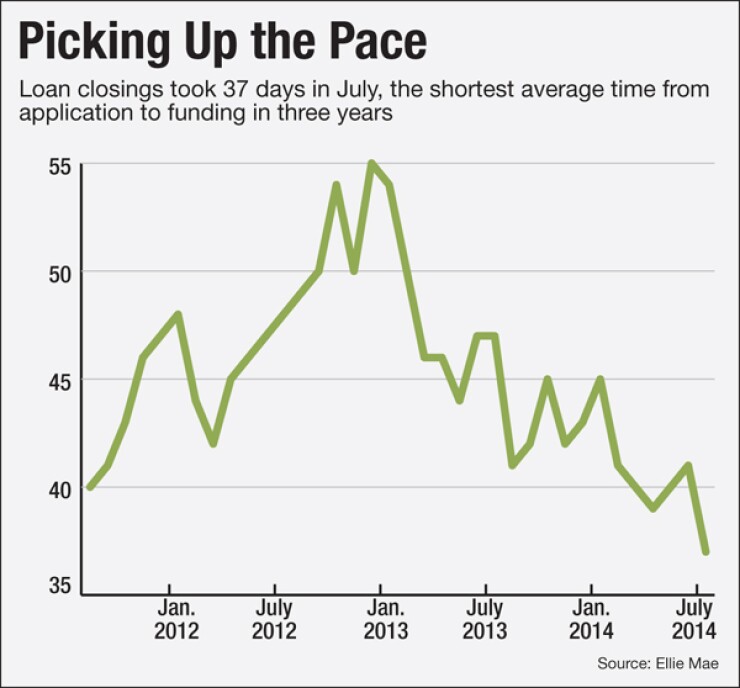

Lenders are closing loan applications more quickly in July than they were three years ago, according to an Ellie Mae report.

The Pleasanton, Calif.-based technology company's July Origination Insight Report, which analyzes mortgage files processed with its loan origination system, showed loans that closed during the month of July took an average of 37 days to go from application to funding. That's the shortest closing time since Ellie Mae began tracking the metric in August 2011.

Conventional loans took about 36 days to close, while FHA and VA loans averaged 38 days, the report said.

"Obviously, lower volume is a factor. But lenders are also working harder to source and convert the leads that are out there," Jonathan Corr, chief operating officer of Ellie Mae, told National Mortgage News via email. "Our lenders have invested in technology and improved workflow to be more efficient."

Another aspect that

"Collecting all the documents from a borrower at once makes the loan application a smoother process," Sawyer said. "A borrower could get frustrated if they have to submit information to their lender multiple times. We educate our sales people so they know what guidelines have to be followed to get an adequate loan through the process in a quick manner."

Ellie Mae said that the July closing rate fell three percentage points, to 57.7%, from a month earlier. The purchase market accounted for 67% of the closed loans, which is the highest percentage in nearly three years.

The average 30-year note rate for all loans declined to its lowest level this year, to 4.39%, a 4-basis point drop from June.

The Origination Insight Report retrieves application data from approximately 57% of all mortgage applications initiated on Ellie Mae's Encompass platform.