An overwhelming majority of

The 20% of surveyed millennials reporting they do currently own a home are carrying a median student debt load of $41,200, which surpasses their median annual income of $38,800. About 79% borrowed money to finance their education at a four-year institution, and just over half are repaying a balance of over $40,000.

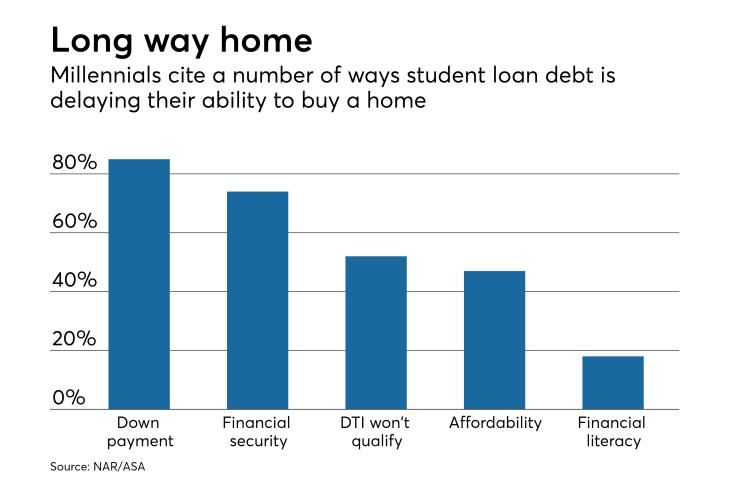

Of the 80% of millennials reporting they do not own a home, 83% claim that student loan debt has affected their ability to buy.

"The tens of thousands of dollars many millennials needed to borrow to earn a college degree have come at a financial and emotional cost that's influencing millennials' housing choices and other major life decisions," said Lawrence Yun, NAR chief economist, in a press release.

"Sales to first-time buyers have been underwhelming for several years now, and this survey indicates student debt is a big part of the blame. Even a large majority of older millennials and those with higher incomes say they're being forced to delay homeownership because they can't save for a down payment and don't feel financially secure enough to buy," he said.

The lifecycle of the housing market is being disrupted by the $1.4 trillion of student debt that U.S. households are currently carrying, according to Yun.

Student debt is also preventing millennials who already own a home from selling and buying a new one, either because the price to move and upgrade is too costly, or because their loans have

This slows the turnover in the housing market at a time when both