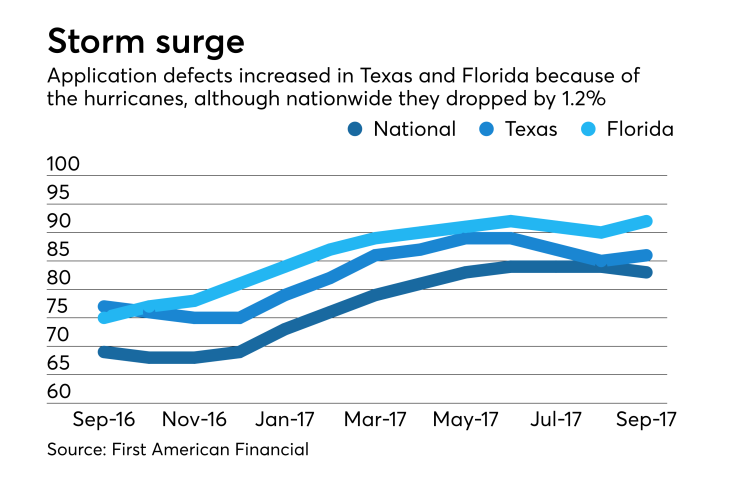

Hurricanes Harvey and Irma were responsible for an increase in loan application defects during September in Texas and Florida, according to First American Financial Corp.

Nationwide, the frequency of defects, fraud and misrepresentations in mortgage loan applications fell by 1.2% compared with August but rose 20.3% compared with September 2016, First American's Loan Application Defect Index found. The month-to-month drop was the first in 2017, after

In Texas, application defects increased 1.18% from August and 11.69% over September 2016. Florida had a 2.22% month-over-month increase in application defects and a 26.32% year-over-year increase.

"Unfortunately, historical data indicates that natural disasters and loan application defect risk go hand-in-hand," said First American's Chief Economist Mark Fleming in a press release. "Our defect, misrepresentation and fraud risk index identified signs of this risk trend

Before the hurricanes, the defect risk in both states peaked in June before declining in July and August. However, the index value in both states has been above the national average. September's nationwide index is at 83, while in Texas it is 86 and Florida it is 92.

"In Houston, which was

Only the smaller markets of Scranton, Pa., up 12.1% compared with August, and Lakeland, Fla., with a 9.1% increase, had a larger increase in the risk for application defects than Houston.

The state with the highest risk index is Arkansas at 106, with Little Rock's 111 the highest among metropolitan areas.