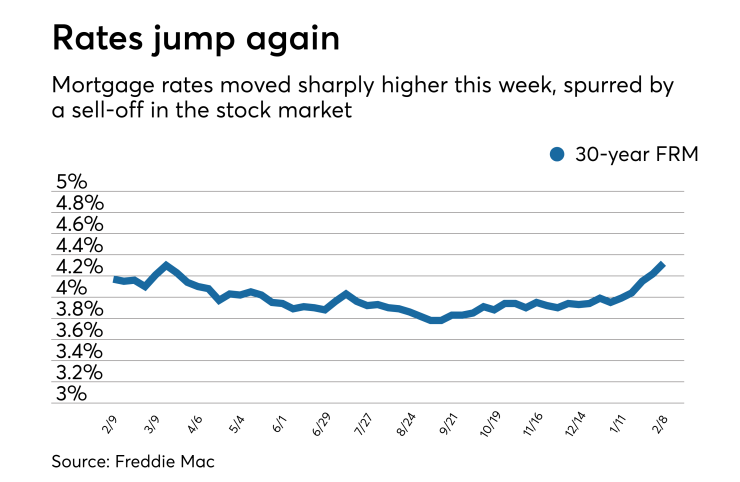

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.32% | 3.77% | 3.57% |

| Fees & Points | 0.6 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.75 |

The 30-year fixed-rate mortgage averaged 4.32% for the week ending Feb. 8,

"The U.S. weekly average 30-year fixed mortgage rate rocketed up 10 basis points this week. Following a turbulent Monday, financial markets settled down with the 10-year Treasury yield resuming its upward march. Mortgage rates have followed. The 30-year fixed mortgage rate is up 33 basis points since the start of the year," Len Kiefer, Freddie Mac's deputy chief economist, said in a press release.

"Will higher rates break housing market momentum? It's too early to tell for sure, but initial readings indicate housing markets are sustaining their momentum so far. The MBA reported that

The 15-year fixed-rate mortgage this week averaged 3.77%, up from last week when it averaged 3.68%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.39%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.57% this week with an average 0.4 point, up from last week when it averaged 3.53%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.21%.

"Mortgage rates moved sharply higher last week, spurred by a sell-off in the stock market and further evidence of a strong economy that will soon force the world's major central banks to push interest rates higher," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Wednesday.