Stewart Information Services, the smallest of the four national title insurance underwriters, initiated some cost-cutting measures that will save it $60 million on an annual basis, company representatives announced last week.

The cutbacks included an undisclosed number of staff reductions across multiple business lines and the corporate operations.

"In these unprecedented times and given the uncertain impact of the COVID-19 pandemic on our business, we continue to take targeted actions and manage our operations to best position our company over the long-term," Stewart CEO Fred Eppinger said in a press release.

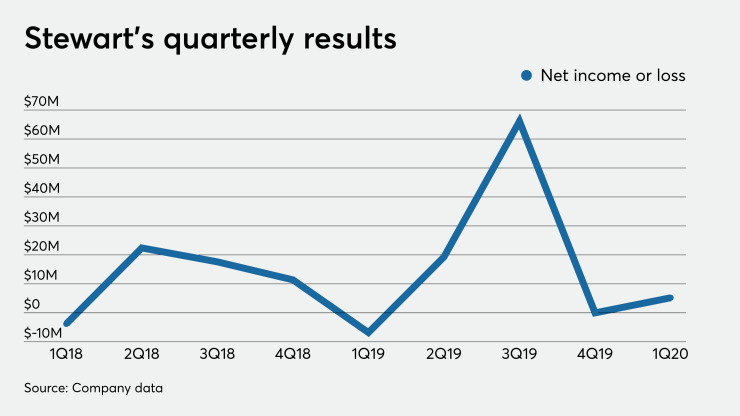

Stewart was

In addition to the layoffs, Stewart lowered discretionary spending levels related to temporary labor, professional services, business promotion and travel.

Furthermore, Stewart enhanced its financial position by increasing the amount available under its current line of credit to $200 million from $150 million; the new agreement maintains the $50 million accordion feature.

The length of the agreement was extended five years to May 2025 and expanded the number of banks in the syndicate.

Stewart now has in excess of $500 million in available liquidity after factoring in $400 million in total cash and investments above regulatory requirements and the $100 million available on the updated line of credit.

The new banks joining the syndicate are BankUnited and Los Angeles-based City National Bank. BBVA USA is the administrative agent and the other lenders are Zions, Iberiabank and Texas Capital Bank.

There were $15.81 billion of title insurance premiums written in 2019, of which Stewart did 10.6%, according to the American Land Title Association. Fidelity National did 33.2%, First American 25.8% and Old Republic 15.4%. The remainder was done by independent title underwriters.

Several times in recent years Stewart has

During the mid-2010s it twice had to

When Stewart did finally put itself up for sale and