The volume of homes sold to first-time buyers during the second quarter reached a high not seen since 1999 and accounted for more than half of purchase mortgage originations.

First-time buyers bought 570,000 homes in the second quarter, according to a market analysis by Genworth Financial. It's the strongest spring for first-time buyers since 1999, when new homeowners bought 599,000 properties, the Richmond, Va.-based private mortgage insurer said.

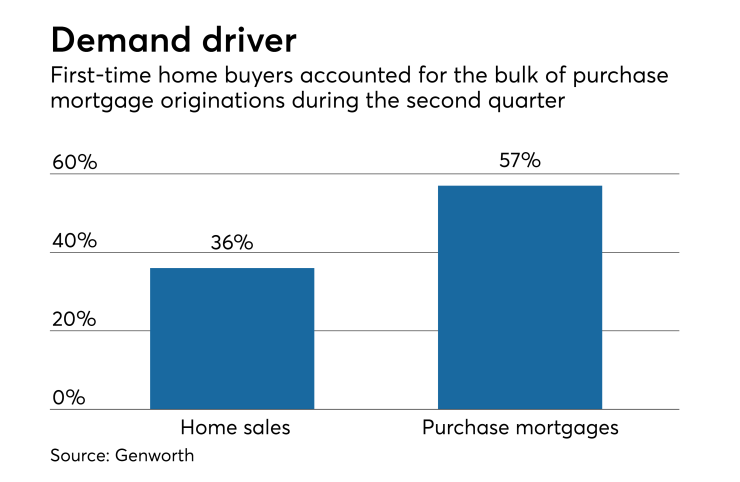

In addition to accounting for 36% of all home sales in the second quarter, first-time buyers made up 57% of the purchase mortgage market, Genworth found. A year ago, consumers making their initial home purchase represented 34% of home sales and 56% of mortgages made to home buyers.

"The current housing cycle will be defined by first-time home buyers," Tian Liu, chief economist for Genworth Mortgage Insurance, said in a press release.

Lenders originated 1.7 million purchase mortgages in the first half of 2017, Genworth estimates, with 969,000, or 57%, of those loans obtained by first-time buyers. During the same time, first-time buyers bought 996,000 properties — meaning 97.3% of all first-time buyers used a mortgage to purchase a home. Put another way, just 27,000 first-time buyers paid cash for their homes.

The

"As first-time home buyers continue outpacing the rest of the single-family homes market, homebuilders have begun adjusting their products further down the pricing curve," Liu said. "However, the growth in supply has not been sufficient enough to offset the supply-demand imbalance, leaving many potential first-time home buyers still frozen out of the market."

Although inventory availability has improved somewhat, the supply of vacant homes hit a low not seen since 1994. Home prices could continue rising as a result.

"While many forecasters predict that increased supply will stem home price appreciation, we believe a slowdown in home price appreciation will be unlikely in 2017 and 2018," said Liu.

He believes the rate of appreciation will be sustainable.

"We do not believe that the strong growth in home prices is leading to another housing bubble," Liu said. "A key feature of housing bubbles is speculative demand. Today, first-time home buyers are outbidding investors and cash-buyers."