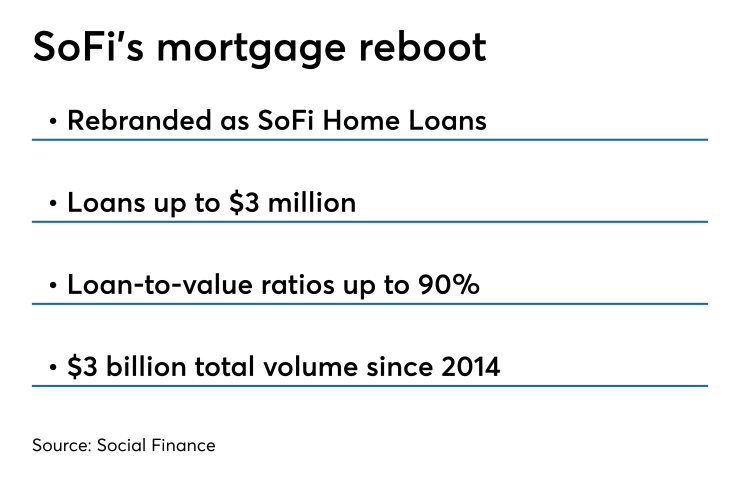

The digital lender Social Finance rebranded its mortgage business as SoFi Home Loans about four months after it took a step back from real estate finance to redesign its processes.

Late last year, SoFi

"We've taken everything we've learned in making lending convenient and painless, and brought it to SoFi Home Loans," Anthony Noto, SoFi's chief executive, said in a press release.

Applicants can prequalify online in as little as two minutes. There is a team to provide users support throughout the process.

In January 2018, SoFi acquired the engineering and product teams from a mortgage startup, Clara Lending, to spur technology development.

SoFi is offering programs up to a 90% loan-to-value ratio with dollar amounts up to $3 million. Applicants can choose between four different loan terms and fixed or adjustable rates for purchases and refinancings.

SoFi entered the

There are two companies with separate Nationwide Multistate Licensing System numbers under the SoFi banner. Besides the wholly owned SoFi Lending, the company has a joint venture with Stearns Mortgage named SoFi Mortgage.

In May 2016, SoFi Lending was

SoFi still offers that product, which is also available to all Fannie Mae sellers, the company said.

Fannie Mae remains SoFi's only conforming secondary market outlet. It does not offer conforming products through its core business.

If SoFi Home Loans isn't able to handle a loan request, the company can digitally transfer member information to its affiliate partner, the press release said.

From its 2014 inception through December 2018, SoFi did over $3 billion of mortgages.

To put that into perspective, Guild Mortgage, a San Diego-based independent mortgage banker, originated $16.5 billion in 2018, up from $15.9 billion the prior year.