For banks between $10 billion and $100 billion, the average exposure is 165% of capital. For the smallest banks, whose asset size is under $10 billion, that percentage is even higher, at 184% of capital, the company found.

By comparison, at larger banks, which are typically more diversified, there's an average of 50% of capital exposed to commercial real estate and construction lending.

The ratings agency views

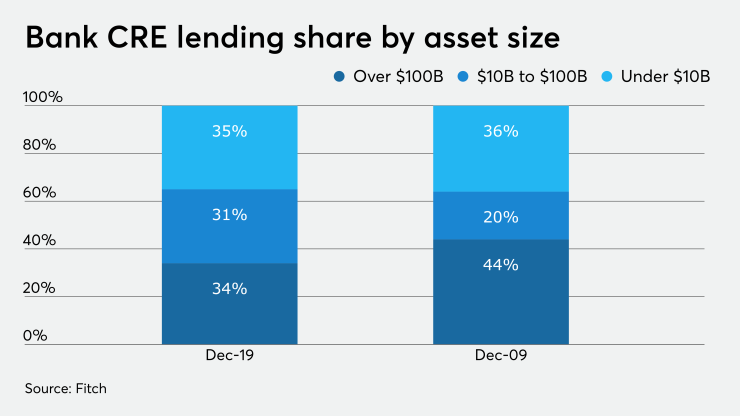

Due to a large number of forbearances though, Fitch stated that the ultimate impact for all institutions is difficult to determine in the short term. They note, however, that smaller banks increasingly make up a larger share of the entities doing commercial real estate lending.

"Since the Great Recession of 2008, smaller banks have gained market share in the U.S. bank CRE lending market. Banks with $10 billion to $100 billion in assets have demonstrated particularly strong participation and growth in investor CRE lending while large banks have pulled back," said the report from Johannes Moller and Christopher Wolfe. They note that larger banks have become more diversified because of this shift.

The adoption of conservative underwriting guidelines after the Great Recession will help mitigate some of the risk for the depositories, whose practices Fitch views more favorably than for the "more loosely regulated

"Specifically, for the banks in Fitch's rated universe, it is very seldom that loans held on [a] balance sheet on stabilized properties are approved when they rely on future cash flow or occupancy before debt service coverage requirements are met. In such cases, banks typically look for additional creditor protection like sponsor recourse, cross default clauses, cash escrows or some combination of these," the report said.

While exposure to hotel and lodging properties is low, representing less than 10% of bank CRE portfolios, Fitch expects that segment, along with retail, to have the highest delinquency rates amid the fallout from the pandemic.

Retail is a particular problem at some smaller banks, where mortgages secured by these properties make up 30% or more of their portfolio.

Going into the shutdown, commercial real estate delinquency rates across all investor types remained low, according to Mortgage Banker Association data released on June 18. At the end of the first quarter, the 90-day-plus late payment rate at banks and thrifts was 0.51%; while still historically low, it was up from 0.42% at the

By comparison, the 30-day delinquent and real estate owned rate for commercial mortgage backed securities was 1.79%, down 28 basis points from the fourth quarter and 82 bps year-over-year.

The first-quarter delinquency rates were negligible for Fannie Mae, 4 bps; Freddie Mac, 8 bps; and life insurance companies, 4 bps.

"This year's first quarter marked the end of a long period of extraordinarily low and stable delinquency rates for commercial and multifamily mortgages," said Jamie Woodwell, the MBA's vice president of commercial real estate research in a press release.

"With the onset of the COVID-19 pandemic and our social and economic responses to it, more recent data from MBA and others show increasing pressure on delinquency rates, particularly for loans backed by hotel and retail properties, where the impacts have been most immediately and dramatically felt."

The delinquency rate for Fitch's rated CMBS portfolio was 1.46% at the end of May, up 14 bps from 1.32% in April and 1.31% for March.

Its latest report