Economic issues were the biggest influence on average mortgage rates in the past week, although two trackers moved in different directions.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.65% | 3.14% | 3.38% |

| Fees & Points | 0.6 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.75 |

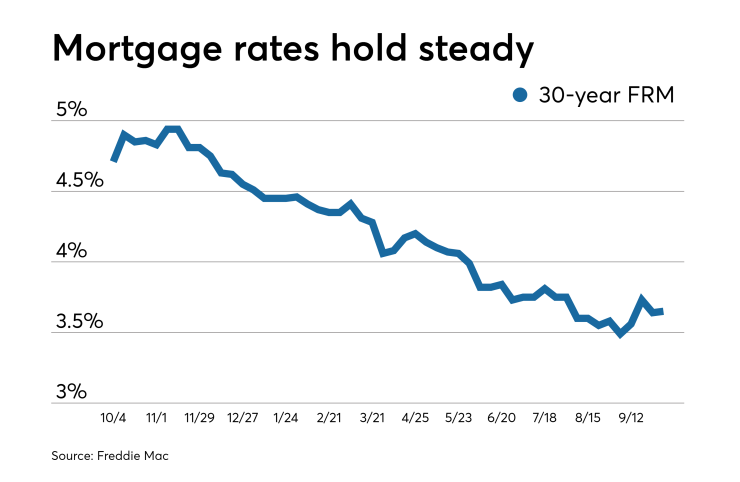

The Freddie Mac Primary Mortgage Market Survey was relatively flat for the week ended Oct. 3, with the 30-year mortgage average

But the Zillow rate tracker fell 13 basis points to 3.61% on Oct. 2 after peaking at 3.74% on Sept. 26.

Rates are still much lower than a year ago at this time, when the 30-year fixed-rate mortgage averaged 4.71%, Freddie Mac said.

"While mortgage rates generally held steady this week, overall mortgage demand remained very strong, rising over 50% from a year ago thanks to increases in both

In Zillow's measurements, poor economic news had a more immediate impact on mortgage rates.

"Mortgage rates fell this week, as a slew of weak economic data stoked fears of an economic slowdown and pushed investors to safer assets," Matthew Speakman, a Zillow economist, said when that company released its own rate tracker. "After two weeks of consistent increases in mid-September, rates spent the last seven days retreating to their lowest level in nearly a month, bowing to many of the same pressures that have consistently placed downward pressure on them for the better part of this year: lackluster economic reports that highlighted the risks of continued trade tensions between the U.S. and China."

The 15-year fixed-rate mortgage averaged 3.14%, down from last week when it averaged 3.16%, according to the Freddie Mac survey. A year ago at this time, the 15-year fixed-rate mortgage averaged 4.15%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.38% with an average 0.4 point, unchanged from last week. A year ago at this time, the five-year adjustable-rate mortgage averaged 4.01%.

Expect continued volatility for mortgage rates in the short term, Speakman said.

"[Last] Friday's disappointing consumer spending release and Tuesday's report on manufacturing activity, which hit a 10-year low, were the most impactful" for this past week's rate movements, he said. "With September's jobs report due Friday, markets remain on edge, which will likely bring more significant rate swings."