The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

However, delinquency rates are likely to reach a turning point next year, as a greater number of newly originated loans become late on their payments, said Steve Jellinek, who authored the report.

The current economic expansion does not show any signs of a "boom or bust cycle" with average annual real gross domestic product growth rate of 2.3% and unemployment expected to remain at its current range of 3.7%.

This data, along with annual average job growth of 2.3 million per year between 2010 and 2018, "shows there are no huge imbalances or signs of overheating in the economy, which usually precede a recession," Jellinek said.

Commercial real estate price growth is expected to moderate over the next three years, at 5%, 3.7% and 2.8%, respectively, after averaging 7.7% over the past three years.

"The upshot of this slow and steady expansion is that it may prolong the current business cycle," Jellinek said. "Commercial real estate will benefit from this pace of growth. Demand for commercial space is strong, but not so robust as to spur excess lending and speculative new development."

Meanwhile, lenders now put

The Federal Open Market Committee's

"Competitors, from mortgage real estate investment trusts to private debt funds, have increasingly stepped in to offer borrowers an array of alternatives. Because of this and a lull in refinance volume, we expect CMBS originations to finish the year around $75 billion," he said.

In 2018, new issuances compiled $83 billion, compared with a post-crisis high of $95 billion in 2015. New issuance volume in the first nine months of the year totaled $56.1 billion.

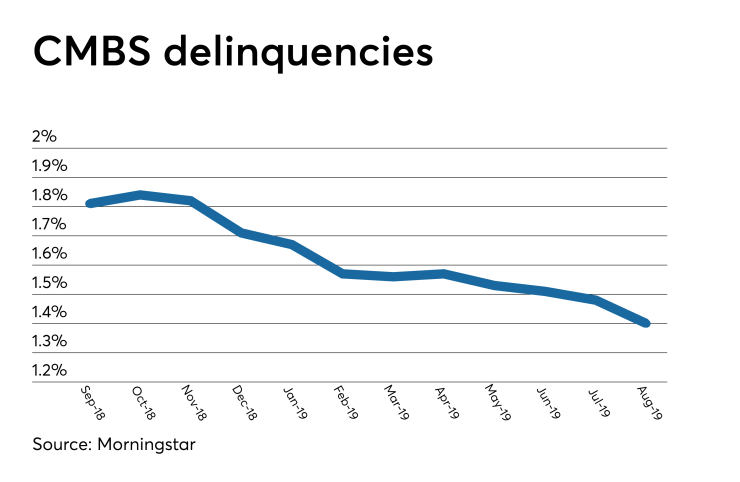

Meanwhile, delinquencies continue their steady decline, but as older legacy loans pay off and more CMBS 2.0 mortgages become late on their payments, it is likely 2020 will be an inflection point, Jellinek said.

Earlier this year, Morningstar was concerned that

August accounted for $4.36 billion of CMBS 2.0 delinquencies, up from $2.91 billion year-over-year.

Still, CMBS delinquencies fell 44 basis points since October 2018, to 1.4% in August.

While the unpaid principal balance of loans in special servicing dropped to a post-crisis low of $15.55 billion in August, the dollar amount of CMBS 2.0 loans rose to $6.49 billion, up from $5.22 billion one year ago.