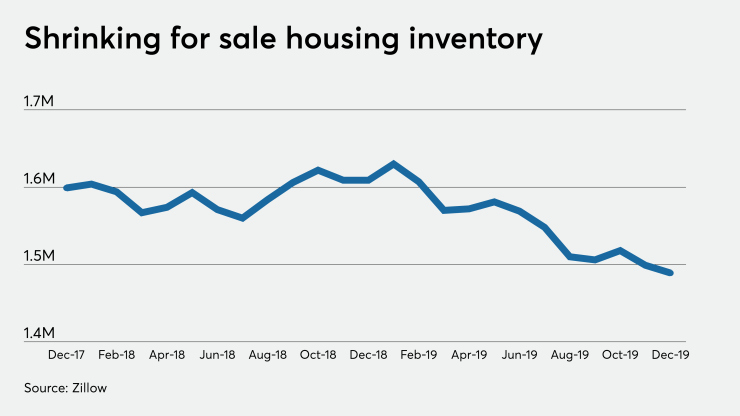

The inventory of homes for sale is at a seven-year low and that is likely to continue to shrink in the coming months, a Zillow report said.

This stands as a marked contrast to the optimism felt

"The end of 2019 looks a whole lot different than we might have expected at the beginning of the year," Skylar Olsen, director of economic research at Zillow, said in a press release. "A year ago, a combination of a government shutdown, stock market slump and mortgage rate spike caused a long-anticipated inventory rise."

"That supposed boom turned out to be a short-lived mirage as buyers came back into the market and more than erased the inventory gains. As a natural reaction, the recent slowdown in home values looks like it's set to reverse back to accelerating growth right as we head into home shopping season with demand outpacing supply," Olsen said.

Inventory fell 7.5% annually to its lowest level since Zillow started tracking this data in 2015.

The number of homes for sale dropped year-over-year in 31 of the 35 largest U.S. housing markets, with San Antonio, up 8.1%; Detroit, 7.6%; Atlanta, 1.8%; and Chicago, 0.6%; as the only exceptions. The markets with the largest decline in inventory during 2019 were Seattle, down 28.5%; San Diego, down 23%; and Sacramento, down 21.7%.

In November, Zillow said a

At the same time, high demand for the small amount of homes on the market could cause home price growth to accelerate again.

While price growth slowed compared with November for the 20th consecutive month, the gap is the smallest since the slowdown began, Zillow said.

Home values grew 3.7% on a year-over-year basis in December, compared with 3.8% annual growth for November. The Zillow Home Value Index was $244,054 in December, compared with $243,231 in November and $235,237 for December 2018. In its boom-era peak of December 2006, the index was at $213,182.

This is in line with