Crossroads Systems Inc. has relaunched with the acquisition of a community development financial institution focused on the Hispanic mortgage market, taking a $344,000 net loss in its fiscal first quarter.

Crossroads, the successor to a bankrupt intellectual property licensing business, now is operating primarily as the holding company for Capital Plus Financial, a CDFI that offers a long-term fixed-rate mortgage product and provides affordable housing in Texas.

The company's first operating results since the acquisition reflect its operations between Dec. 19 and Jan. 31 and show it recorded $3.28 million in revenue and generated $1.34 million gross profit during the period.

Crossroads, which has been trading at $4 per share as a penny stock under the new ticker symbol CRSS, recorded $483,000 in one-time expenses related to the acquisition of Capital Plus and $258,000 of other one-time expenses. It has $3.6 million in cash and cash equivalents.

"The acquisition of Capital Plus Financial and its immediate positive impact to earnings along with the continued wind down of Crossroads' legacy expenses, position the company for growth and creation of shareholder value," said Crossroads CEO Eric Donnelly in a press release.

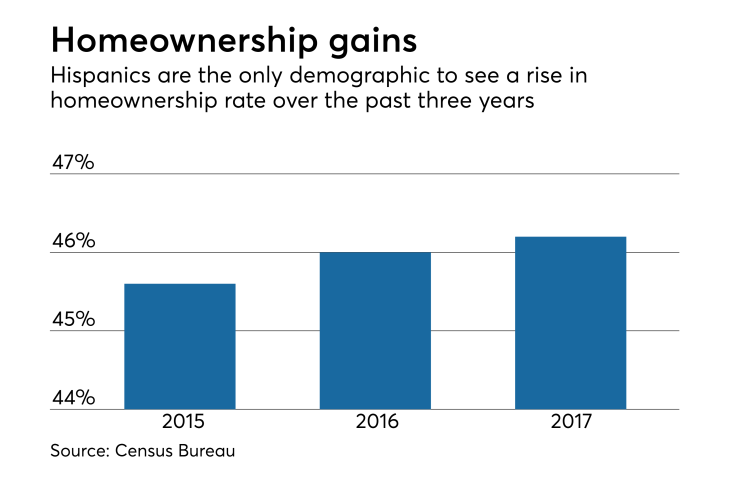

Hispanics are the only demographic that has seen its homeownership rate increase

"It is not clear what drove those gains," according to the report. "Early data regarding homeownership gains by age cohort suggest millennials represented significant percentages of purchase mortgage originations in markets across the country."