After over two years of falling delinquency rates, the burgeoning unemployment following the coronavirus shutdown will bring a surge of outstanding mortgages, according to CoreLogic's Loan Performance Insights Report.

Delinquencies decreased annually for the 26th consecutive month in February to 3.6%, down from

"The pandemic-induced closure of nonessential businesses caused the April

In February, early-stage delinquencies dipped annually to 1.8% from 2%. The share of mortgages 60-89 days past due held at 0.6%. The serious delinquency rate — mortgages 90 or more days past due, including foreclosures — edged down to 1.2% from 1.4% year-over-year, the lowest rate since 1% in April 2000. The foreclosure inventory rate stayed static at 0.4%,

For the fifth straight month, zero states had annual increases in delinquency rates. Maine and Mississippi led the country with 0.9% year-over-year decreases. Delaware, Louisiana and North Carolina followed with declines of 0.8%.

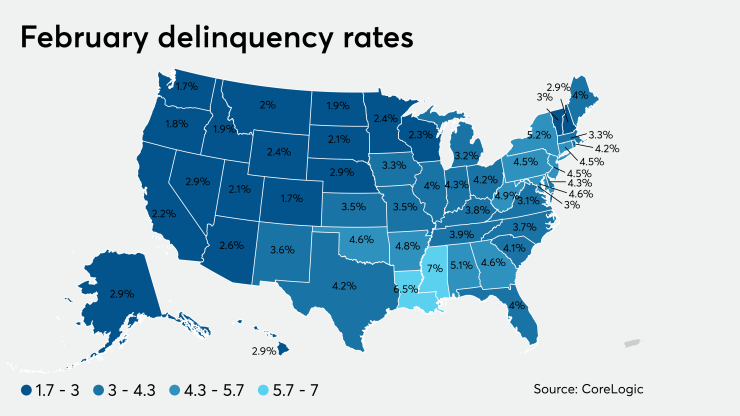

Overall, the lowest delinquency rates come Colorado and Washington at 1.7%, Oregon at 1.8%, then Idaho and North Dakota at 1.9%. Conversely, the highest rates were in Mississippi at 7%, Louisiana at 6.5%, New York at 5.2% and Alabama at 5.1%.

With financial hardships and

"After a long period of decline, we are likely to see steady waves of delinquencies throughout the rest of 2020 and into 2021," said Frank Martell, president and CEO of CoreLogic. "The next six months will provide important clues on whether public and private sector countermeasures — current and future — will soften the blow and help us avoid the protracted, widespread foreclosures and delinquencies experienced in the Great Recession."