Growth in home prices remained churning at a steady pace, with sellers holding out for better returns and suppressing the supply of available housing.

Property values rose 6.2% year-over-over and

"Many consumers see their homes as good investments. Our consumer research indicates homeowners, especially those in high-price growth markets, are confident that by waiting to sell, they will receive a greater return on investment than they would today," Frank Martell, president and CEO of CoreLogic, said in the report. "In other words, sellers are largely staying put. With fewer homes on the market, price pressure will continue to rise."

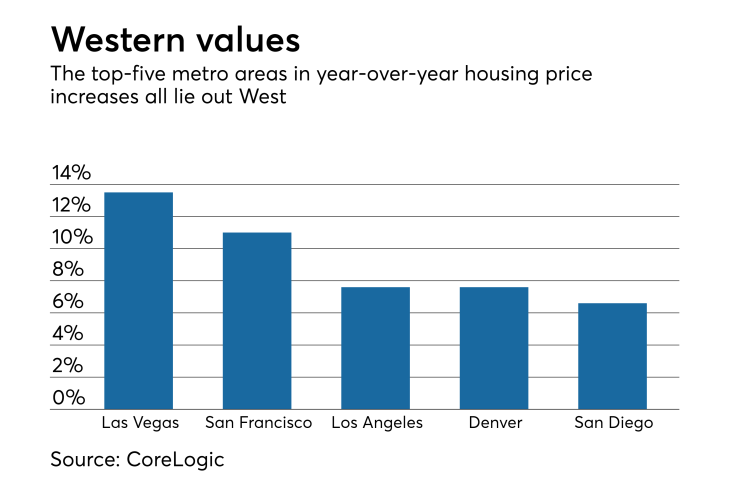

At the state level, Nevada had the highest increase in home prices with 12.9%, followed by Idaho's 12.3% and Washington's 10.4%. Only North Dakota had a year-over-year decrease in July.

"With increased interest rates and home prices, the CoreLogic Home Price Index is rising at a slower rate than it was earlier this year. While markets in the Western part of the country continue to experience rapid home-price growth, many of those metros are over-valued, and will likely experience a slowdown soon," Frank Nothaft, chief economist for CoreLogic, added in the report.

However, residents of these high-growth markets have high expectations as well, with 62% believing their home values will increase in three years, compared to 58% of low HPI growth markets and 45% of no-growth or negative-growth areas anticipating home price increases three years from now.

CoreLogic forecasts housing values to rise another 5.1% from July 2018 to July 2019, but fall 0.2% for August's report.