Even with "a more fiscally conservative, limited-government, and

For one thing, the Basel III capital requirements are making it hard for banks

As a result, institutions are selling mortgage servicing rights at a record pace, he said Wednesday at the Mortgage Bankers Association servicing conference in Dallas.

When banks sell MSRs, they lose an asset that earns money and "the natural hedge" of the fee income that servicing provides in a rising interest rate environment, said Motley.

This indirectly hurts borrowers, he argued. "The punitive capital treatment reduces demand for MSRs, creating a less liquid market that could result in lower prices for mortgages sold in the secondary market, and higher rates for consumers."

Hence, regulators need to

The government also needs to reduce the regulatory burden on servicers put in place by the

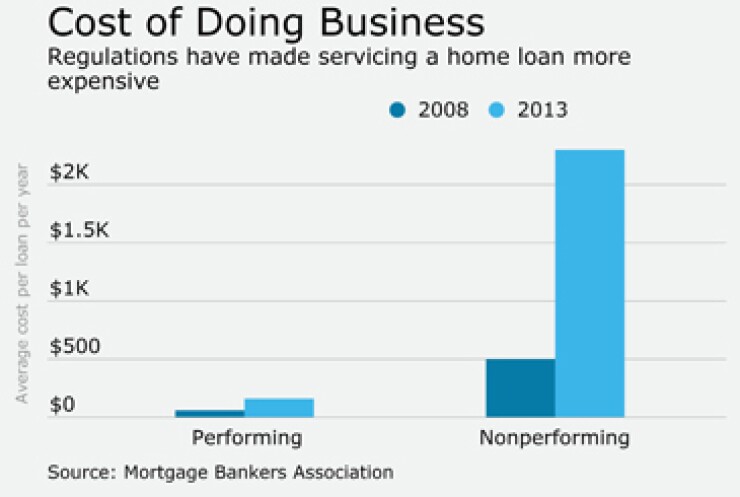

That burden is why the cost to service a performing loan has increased from about $60 to nearly $160 per year from 2008 to 2013, while the cost to service a nonperforming loan has risen from nearly $500 to around $2,300 over the same time period.

"The punishment doesn't fit the crime" when it comes to

State and federal servicing regulations need to be aligned to help reduce the cost burden and level the playing field between bank and nonbank servicers (which are state-regulated entities), he said.

Speaking of FHA, Motley said the agency's foreclosure timeline rules need to be aligned with those used by the government-sponsored enterprises Fannie Mae and Freddie Mac. The FHA standards are 20 years old and contrary to the spirit of CFPB's loss mitigation rules, he said.

"FHA should also follow the GSEs’ direct conveyance approach which will both reduce costs for FHA servicers and allow foreclosed properties to be purchased by new owners who want to become part of the community," Motley said.