Mortgage rates fell for

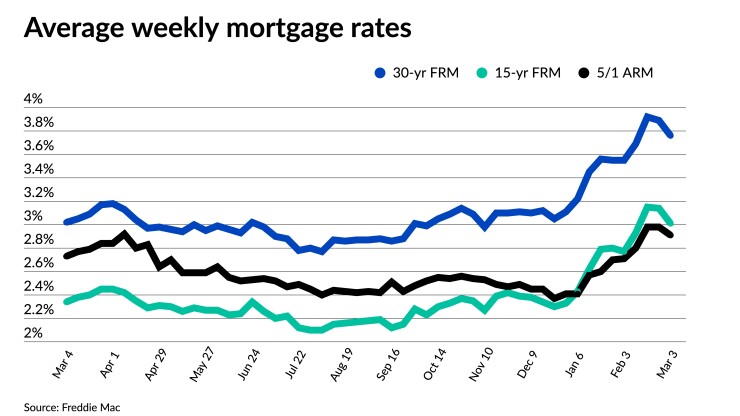

The 30-year fixed-rate mortgage average fell 13 basis points for the seven-day period ending March 3 to 3.76% from 3.89%. In the same week a year ago, the average had settled at 3.02% and ended 2021 at 3.11%.

“Geopolitical tensions caused U.S. Treasury yields to recede this week, as investors moved to the safety of bonds, leading to a drop in mortgage rates,” said Sam Khater, chief economist at Freddie Mac.

While the conflict in Eastern Europe dominated headlines over the past week, the economic factors behind the jump in mortgage rates throughout the winter have not ceased, with inflation still climbing. On Wednesday,

“As indications of inflation have mounted, many believed a half-point rate hike was likely at the Federal Reserve’s mid-March meeting,” said Marty Green, principal at mortgage law firm Polunsky Beitel Green, in a statement sent to National Mortgage News. “However, the Russian invasion of Ukraine has created an environment of uncertainty that we believe may cause the Federal Reserve to instead adopt a more moderate quarter-point increase.”

In a research blog post, Paul Thomas, vice president of capital markets at Zillow, noted, “Under normal circumstances, aggressive action in response from the Federal Reserve would be expected in order to contain inflation. But geopolitical concerns over the Russian invasion of Ukraine prevented a significant increase in rates.” A protracted war adds further question marks.

“The Ukraine situation is resulting in expectations for higher energy prices, putting further inflationary pressure on the global economy,” Thomas added. “At the same time, sanctions imposed on Russia are likely to result in slower economic growth.”

These recent developments have experts largely guessing where mortgage rates may immediately head, although Khater foresees them staying low in the short term before increasing again in the coming months.

Investors, along with the rest of the world, will continue to watch how the situation in Ukraine unfolds.

“Markets are likely to be volatile in the near term with geopolitical developments driving much of the direction in rates.” Thomas said.

The 15-year fixed-rate mortgage average also saw a similar decline compared to the 30-year, falling 13 basis points to 3.01% from 3.14% a week earlier. Over the same period one year ago, the 15-year average stood at 2.34%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage headed downward as well, dropping to an average of 2.91% from 2.98%, where it had sat for two consecutive weeks. A year ago, the 5-year ARM average came in at 2.73%.