Helped by what the company termed its best ever quarter for purchase originations, Rocket Mortgage is on its way to topping 9.5% market share in the fourth quarter and expects to go above 10% sometime in 2022.

Combined, both purchase and cash-out refinance volume — products that are less sensitive to interest rate movements — were up 70% year-over-year in the third quarter, Rocket Vice Chairman and CEO Jay Farner said during a conference call.

Rocket does not provide breakouts on purchase versus refinance splits. However, KBW "used commentary on the call to estimate purchase/refi mix of 24%/76% (up from 17%/83% last quarter, though still below

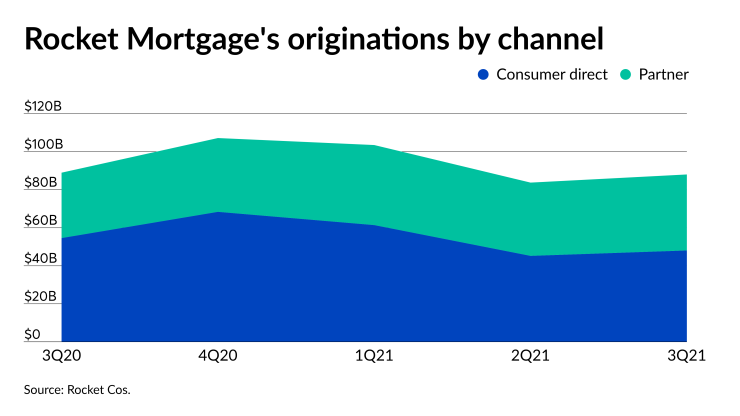

Rocket Mortgage produced $88 billion in mortgages in the most recent period, above its prior guidance and up from $83.8 billion in the prior quarter. But this was down from the year-ago period when it produced slightly under $89 billion.

According to George's calculations, the third quarter purchase volume was approximately $21.2 billion.

"Not only did we set a record for purchase volume in the third quarter with both our direct-to-consumer and partner channels achieving all-time highs, but by the end of September, we had already originated more purchase volume than any full year prior," Farner said. "This rapid growth in the purchase segment puts us well on our way to reaching our goal of becoming the No. 1 retail purchase lender by 2023."

While Rocket Cos. third quarter mortgage originations were down slightly on a year-over-year basis, its gain on sales margin was 147 basis points lower, contributing to a decline in earnings.

Net income fell to $1.39 billion in the third quarter, compared with almost $3 billion

Gain on sales margin for the third quarter was 305 basis points, compared with 278 bps

The Federal Housing Finance Agency's decision

Rocket Mortgage's consumer direct channel did $49.6 billion, with a gain on sales margin of 447 bps, compared with $53.5 billion and a 578 bps margin in the third quarter of 2020.

While originations increased in its Rocket Pro TPO channel (which includes both its wholesale production and partnerships with other entities), the margins slipped severely. The segment’s volume was $37.7 billion for the third quarter, but the gain on sale was a mere 78 bps. A year ago, Rocket Pro TPO did $29.6 billion, but the gain on sale was 270 bps.

As a result, net revenue for this channel fell to $457 million from $1.2 billion for the same period in 2020. In the retail channel, net revenue was $2.5 billion in the third quarter versus $3.2 billion in the prior year.

Still, this channel is seeing growth in business share, Farner said in response to a question. Rocket is locked in

With all the partners it works with, not just brokers, it had grown its wallet share — the percentage of loans they originated that Rocket acquired — to over 50% from 36% four or five months ago, he said.

"So we're really excited about how those partners are committing to working with Rocket," said Farner. "In addition, when we look at just overall market share, we're up two or three percentage points from where we were just a few quarters back, so our growth in that market continues."

Rocket's recent

"The consumer that comes to us directly online is a different consumer than the person who chooses to work with a local mortgage broker, it is a different consumer who chooses to work with their bank or credit union," said Farner. "So this gives us access to a consumer that we may not be reaching day in and day out."

Rocket has expanded its reach into other business lines outside of providing home financing.

"We're also investing to grow beyond mortgage and leverage our platform to scale our newer real estate, auto, personal loans and solar businesses," Booth said. "This growth will come from continued investment in the pillars of our platform, particularly technology fueled by our vast data lake aggregated through millions of client interactions."

It is likely the Salesforce partnership could be expanded into those other product lines, Farner said.

When asked if New York State's recent imposition of its own

Rocket had a $521 billion servicing portfolio at the end of the third quarter, which included acquisitions of $3.6 billion during the period.

"This is in accordance with our growth strategy as we have found that our industry leading retention rates positions us to generate attractive return for select MSR portfolio acquisitions," said Booth. "We remain aggressive in pursuing this strategy and we'll continue to look for opportunities to deploy capital through these types of acquisitions."

For the fourth quarter, Rocket expects closed loan volume of between $75 billion and $80 billion and gain on sale between 265 bps and 295 bps.

KBW's George is projecting Rocket to originate $69.6 billion along 275 bps of gain on sale.