Mortgage originations at Rocket Cos. will increase from the record set in the second quarter, but gain-on-sale margins should be lower for the current three-month period, the company said on its earnings call.

"As we look to the second half of the year, we continue to see strength and durability in consumer sentiment," said CEO Jay Farner during the call. "Record low interest rates and an improving U.S. real estate market continue to drive demand for home loans. The purchase market, in particular, continues to recover following COVID-related disruptions in the second quarter. In fact, we expect the third quarter to be one of our best for purchase origination volume ever at Rocket Mortgage."

This was the formal release of its second-quarter results; the data was

Indications are that the company will surpass the $72.3 billion it produced in the second quarter, and will end up originating between $82 billion and $85 billion for the third quarter.

Just under half of the company's mortgage volume during the second quarter, 46%, came from its existing servicing portfolio getting their next loan, said Chief Financial Officer Julie Booth.

"These transactions … come with little to no client acquisition costs, leading to substantial incremental profitability," Booth said.

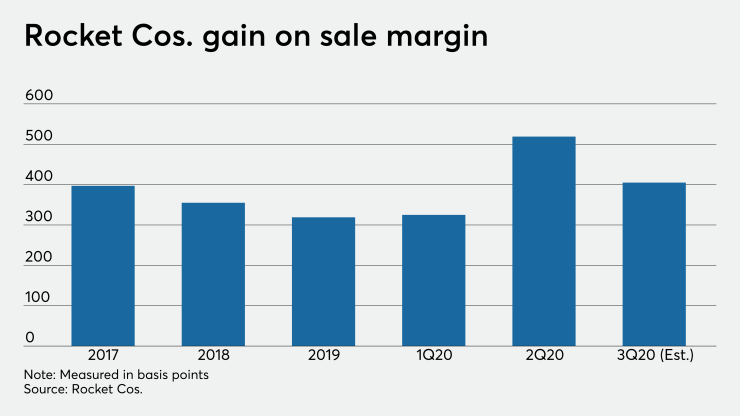

Gain-on-sale margins should be between 405 basis points to 430 basis points for the third quarter, down from 519 bps for the second quarter. Even with the drop off, those margins are elevated compared to historic norms, Booth pointed out.

"With where rates are anticipated to be, I think we'll continue to see strong demand for some time," Booth said. "Primary [to] secondary spreads are wide right now, so you may see an opportunity for those to come back in, but I think 405 to 430 that we're looking at here in 3Q are still very strong."

Over time, gain-on-sale margins are likely to return to "more normalized levels," but there is some "runway" for those to remain elevated over the coming quarters, she continued.

Rocket Cos. ultimate goal is have a 25% market share of mortgage originations by 2030.

"We obviously don't control interest rates, and so for us, it's critical that we think about long-term growth over an extended period of time and then make all the right moves to make sure that we're growing and gaining market share," Farner said.

Based on

During its yearly planning around the originations market, the company normally anticipates $2 trillion of annual production. With a $3.1 trillion forecast for this year, Rocket will have more growth in volume than expected, Farner said.

While Rocket does expect to see market share growth over the next decade, "it really is not something that we are going to be watching on a quarterly basis, so we may see some ups and downs when we look quarter-to-quarter," Booth added.