The percentage of flood damage to residential properties from Hurricane Harvey that is uninsured is turning out to be a little higher than earlier estimates.

Approximately 75% of the $25 billion to $37 billion in flood damage to residential properties from Hurricane Harvey was uninsured, according to CoreLogic's annual Natural Hazard Risk Summary and Analysis report.

That estimate is up slightly from the 70%

However, earlier estimates for the dollar amount of residential damage from Hurricanes Harvey and Irma remain unchanged, as does the estimate for percentage of damage from Irma that is uninsured.

Most borrowers in federally designated flood zones are required to obtain flood insurance, which the government subsidizes. But maps used to determine those zones are continually being updated because they don't always match actual flooding that occurs after a storm, and borrowers may let their policies lapse.

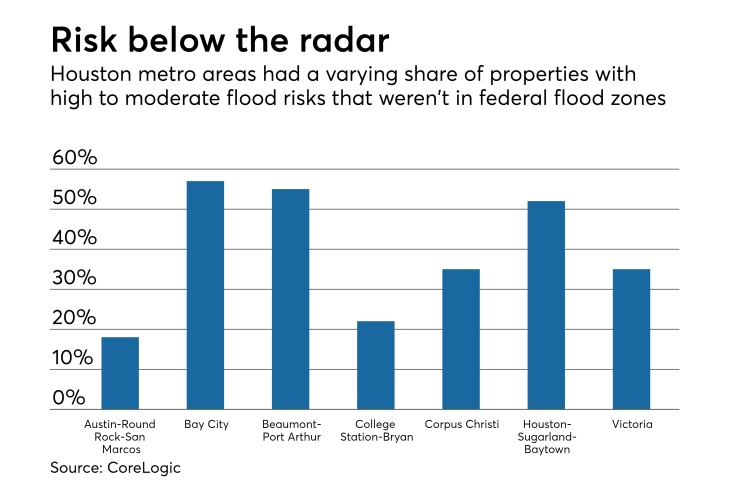

More than half of the commercial and residential properties in the Houston area hit by Hurricane Harvey were considered to have high or moderate risk of flooding, but were not in a federally designated Special Flood Hazard Areas considered to have extreme or very high flood risks.

And the Federal Emergency Management Agency's National Flood Insurance Program has been struggling with financial challenges that have prompted unresolved congressional debate and left the terms of its long-term reauthorization in question.

Most recently the NFIP's reauthorization was extended for another few weeks after a lapse during the brief government shutdown.